Decisiv/TMC report: Parts, labor costs stabilized in Q4 2023

NEW ORLEANS—Maintenance budgeting hasn’t been easy in the first half of the 2020s, as volatility in the supply chain and economy have led to uncertainty in what parts a fleet can get and how much they’ll cost, along with how much to pay the technician using them for repair and replacement jobs.

According to Decisiv and TMC’s latest VMRS (Vehicle Maintenance Reporting Standards) System Service Data Quarterly Report, Q4 of 2023 did provide some relief to this issue. According to the report announced at the 2024 TMC Annual Meeting, parts and labor costs declined 1.4% over Q3 2023, with parts dropping 2.2% and labor by a scant 0.2%. From Q2 to Q3, parts and labor had risen 1.9%. Year over year, parts costs were down 2.2%, however, labor rates were 4% higher than in 2022. This led to an overall 0.2% P&L cost increase YOY.

The full report is available to all registered TMC members.

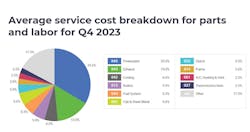

Parts breakdown

Overall, P&L costs are “trending down” and the recent data are “all good signs that the inflationary pressures [from the COVID pandemic and recovery] are definitely easing,” Robert Ziemba, senior director of marketing at Decisiv, told media on TMC press day. Key factors have been improvements in the supply chain and new trucks becoming available.

According to the report, powerplant (045) accounts for a third of service costs, followed by exhaust (043) at 15%, and cooling (042) and brakes (013), both around 6%.

From 2022 to 2023, there were some significant part and labor cost increases in certain areas:

- Power take off (056): 17.5%

- Wheels, rims, hubs, and bearing (018): 14.6%

- Cab and sheet metal (002): 13%

From Q3 to Q4, 2023, aerodynamic devices (004) saw an 8.2% spike in P&L costs.

At one point—from Q2 2020 to Q2 2021—several critical systems were seeing large spikes: lighting systems costs rose 17.4%, transmissions costs by 16.4%, and brakes by 11.1%.

On the other side, there were some notable P&L decreases from Q3 to Q4 2023:

- Tires (017): -15%

- Steering (015): 11.4%

- Cooling systems (042): 10.2%

Labor costs

Any drop in parts prices is surely welcome, but they do not counter that 4% labor increase YOY. Ziemba noted labor to parts costs is a 1.5:1 ratio. That means fleets spend 50% more on labor than parts.

And fleets shouldn’t get too excited about that 0.2% decrease last winter.

“Even though it was only a small change this quarter, it's likely going to continue an upward trajectory,” Ziemba noted.

He noted various industry projections, such as from TechForce Foundation, indicate a strong demand for technicians in the next few years. TechForce adjusted its outlook for technician demand (automotive, diesel, collision, and aviation) from 1 million to 795,000 from 2023 to 2027, but the organization found there are still 3.1 diesel jobs available for every graduate. It should be noted shops can hire those with little to no technical education and perform on-the-job training.

After the press event, Fleet Maintenance met with Dick Hyatt, president and CEO at Decisiv, who offered how impactful the technician shortage is.

“I tried to take my car in the other day, and they were booking any kind of analytic appointments about 45 days out,” he revealed.

The data insights provided by VMRS can provide some relief in terms of labor cost by scheduling technicians to jobs based on their skill level, Hyatt said.

“If you get the lower price entry-level technicians on the right jobs, and get really good at assigning the master techs to the engine work or electrical stuff, then you can arbitrage your cost,” he said. “The goal is to keep the expensive, high skilled technicians off of the simple jobs.”

He added he “[doesn’t] think we do a great job in the heavy-duty business of doing that.”

By using the VMRS codes and assigning labor codes to jobs, as well as segmenting the right tools for various jobs, shops can become more efficient with what they have.

“The real opportunity is to start to anticipate work that needs to be done or provide the mechanism to schedule it,” Hyatt concluded.

How the data was compiled

That data is based on service and repair events entered through Decisiv’s service relationship management (SRM) platform, which encodes events with VMRS codes. Decisiv analyzes service data from around 74,000 fleets using machine learning and artificial intelligence algorithms. The platform tracks more than 300,000 service and repair events per month, and from those captures about 615,000 service-related operations. The algorithms can encode the VMRS identifiers in three-fourths of these operations. For example, if a technician writes “replacing dpf” on a work order, the SRM platform’s AI will detect that and assign the exhaust system code (043).

This allows greater transparency into operations and helps fleets better understand what systems account for the largest average share of parts expenses, as well as how to identify bottlenecks in service and how to improve processes, Ziemba explained.

Decisiv, which has run this report for more than three years, expanded from nine to 25 VMRS system classifications in 2023.

“With the expansion to 25 system codes, we now cover 97% of the price of labor costs, so this is very comprehensive data,” Ziemba noted.