Tariffs, Trump, trade: What the automotive industry is monitoring this year

“Trump actually threatened to impose tariffs on Mexico in 2019 under IEEPA,” Meuwissen said. “But this threat was subsequently removed after bilateral negotiations between the two countries.”

Read more: Trucking economist Dieli says economy still 'recession eligible' in 2025

Trump’s treasury secretary, Scott Bessent, shared his attitude toward tariffs during his Senate hearing. When testifying before the Senate, Bessent outlined tariffs as a methodology for three potential outcomes:

- As a means to remedy unfair trade practices,

- As a revenue raiser for the United States, and

- As a negotiating tactic for non-tariff issues

“I think that gives us some insight into the thinking of the president’s senior advisors coming in,” Meuwissen said.

Trade with Mexico, Canada

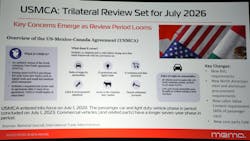

The United States-Mexico-Canada Agreement is another of MEMA’s top priorities. The trade deal has major influence on the U.S. economy broadly and the automotive industry specifically.

USMCA is a renegotiation of the North American Free Trade Agreement under Trump’s first term. The renegotiation brought significant changes for the automotive and commercial vehicle sectors.

“This is the most stringent automotive and commercial vehicle agreement that we have on the books in the United States,” Meuwissen said. “We basically had a complete rewrite of our chapter of the agreement, with brand new rules and requirements being put in that impact the sector every day.”

The agreement entered force on July 2020 and has a 16-year timeline. Different vehicle classes covered by the agreement have multi-year phase-in periods. Passenger car and light-duty vehicles had a three-year phase-in period, which ended in 2023. The phase-in period for commercial vehicles is seven years and concludes in 2027.

Another significant change for the agreement is a review mechanism. Review for USMCA is scheduled for July 2026, where the three countries will discuss how the agreement is working and make changes. However, the U.S. has never experienced a trade agreement review process like this, so the outcome of the review is uncertain.

“Honestly, we don’t know how the reviews can be managed,” Meuwissen said. “We’ve never done one like this before; there’s no prototype for this type of review.”

Some terms that the countries might renegotiate include restricting Chinese investment in Mexico, stricter regional value content requirements, and increased duty rates to compel compliance.

MEMA has a USMCA working group, started in 2024, and is meeting with officials to facilitate negotiations.

“We want to make sure that there are not dramatic additional changes to the agreement while the industry is still working through that phase-in period,” Meuwissen said.

Summary

-

Tariff Uncertainty and Potential Impact – The commercial vehicle manufacturing industry in the U.S. could be disrupted by historic tariff proposals, with Trump’s possible plans including increased tariffs on China, Canada, and Mexico, as well as a universal import tariff.

-

Trade Agreement Revisions – The U.S.-Mexico-Canada Agreement (USMCA), a major trade deal impacting the automotive and commercial vehicle sectors, faces a critical review in mid-2026.

-

Tariffs as a Policy Tool: Trump’s former treasury secretary indicated that tariffs could serve as a remedy for unfair trade practices, a revenue source, or leverage for non-trade negotiations.