Parts and labor costs down to end 2024: Decisiv/TMC report

What you'll learn in this article:

- How AI is being applied to VMRS codes

- Decisiv and TMC's latest report on parts and labor costs for Q4 2024

- How parts and labor costs may develop into 2025

NASHVILLE—After going up in Q3 2024, parts and labor costs dropped 1.6% in Q4, according to the latest Decisiv/TMC North American Service Event Benchmark Report. The news was presented at the TMC 2025 Annual Meeting & Transportation Technology Exhibition in Nashville, and is based on Vehicle Maintenance Reporting Standards for the top 25 systems, representing 97% of service events.

The 1.6% drop reflects an anticipated decline in service activity following traditionally higher pre-holiday freight volumes in the third quarter of each year, the companies noted. The volume of service operations did increase 4.7%, though, and parts and labor still went down, which is notable to Decisiv CEO Dick Hyatt.

“Lower parts and labor costs are good news for service providers and fleets after last quarter’s increase,” Hyatt said. “While they indicate that parts supply chains are more stable and there is improved continuity in the ranks of technicians, the data also show that service operations are handling an increase in events more productively and efficiently. With more effective service management, communication, and collaboration practices between their in-house operations and dealers, fleets are realizing how best practices can lead to a better bottomline.”

In Q3 2024, parts and labor costs went up in 19 of the 25 systems tracked. In Q4 only nine went up. Aero systems saw an uptick, while transmission, drivetrain, and rear-axle systems all went down.

This news was tempered by the volatility surrounding the Trump administration's tariffs, which would go into effect April 2, and according to President Trump, be reciprocal. Jack Poster, VMRS manager for TMC, has been discussing with fleets how tariffs will impact parts costs and he said,

"All of their vendors have said, 'You're getting the price increase.'

And the sad thing is they all said, 'Once they increase it, they never bring the price back down,'" Poster added.

Use of AI

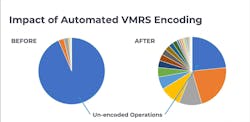

Robert Ziemba, Decisiv VP of marketing, explained that this year the company embedded the machine learning algorithm directly into the Decisiv platform, enabling real-time analysis of service operations that aren't already encoded with VMRS codes. This results in a much more comprehensive survey, with fewer operations left unencoded.

As the technology progresses, even more insights and efficiency should be revealed, Poster asserted.

"AI is the most exciting thing to happen to VMRS in the history of the VMRS,” he said.

He said machine learning and automation will speed up work order creation, and the data will also be more accurate, and by extension, more valuable. There’s only one thing Poster regrets about all of it.

“I wish I was a lot younger so I can stick around to see what's gonna happen, because it's amazing,” he said.

The full report is available to all registered TMC members.

Parts and labor

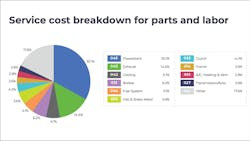

Similarly to the results of last year, powerplant (045) accounts for around a third of service costs, with another third split between exhaust (043) and “other”. The final third is made up of eight categories, with cooling (042) and brakes (013) leading at around 6%.

Despite the overall decrease, there were a few increases in parts and labor costs from Q4 2023 to Q4 2024:

- Aerodynamic Devices (004): 6.3%

- Transmission - Main, Automatic (027): 5.8%

- General Accessories (051): 5.3%

Aerodynamic devices (004) saw a jump of 6.4% from Q3 to Q4 of 2024 alone.

Here are the significant decreases in P&L costs YOY:

- Transmission - Main, Manual (026): -8.9%

- Axle Driven - Rear (022): -8.1%

- Drive Shaft(s) - (024): -6.1%

Ziemba suspects that the proliferation of automated driver features and ADAS could be a likely suspect driving costs down in these categories.

Future outlook

Q4 of 2024 marked the first reporting period that labor costs fell in “quite a while,” according to Ziemba.

“Even though overall parts and labor were coming down, usually labor was going up and parts were coming down more to compensate it, so the overall cost structure is coming down,” he explained, noting that labor costs have come down 1.9% for the quarter and almost a full percent YOY. “This could point to better technician retention, because that has been one of the key issues driving labor costs.”

All in all, Ziemba and the company are optimistic that last quarter’s report is not indicative of a trend, and that labor costs will continue to fall.

“We'll continue to monitor this, but very good news that last quarter seems to be an anomaly, and that we're seeing parts and labor costs coming back down,” Ziemba said.

How the data was compiled

The data in the report is based on service and repair events entered through Decisiv’s service relationship management (SRM) platform, which uses an AI machine learning algorithm embedded in the platform to encode events with VMRS codes. Decisiv analyzes service data from around 74,000 fleets with more than 7 million commercial vehicles total, tracking over 300,000 service and repair events per month.

Decisiv, which has run this report for more than five years, expanded from nine to 25 VMRS system classifications in 2023.

About the Author

Lucas Roberto

Lucas Roberto is an Associate Editor for Fleet Maintenance magazine. He has written and produced multimedia content over the past few years and is a newcomer to the commercial vehicle industry. He holds a bachelor's in media production and a master's in communication from High Point University in North Carolina.