Average cost of mechanical truck repairs climbs

The average cost of mechanical repairs for commercial trucks reached a record high of $542 during the third quarter of 2020, according to the most recent FleetNet Benchmarkit executive summary. This increase is 19 percent higher than Q2, and marks the second quarter in a row where average cost was above $500 per repair. It is important to note that tires and towing events are not included as part of the mechanical cost per repair.

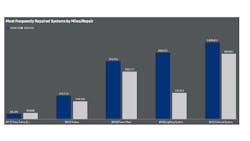

The five most frequently repaired VMRS systems continue to consolidate, according to the report. In other words, the top five Q3 roadside repairs accounted for 72 percent of all roadside repairs experienced by participating fleets. Those systems include tires, brakes, power plant, lighting systems, and exhaust systems.

The average fleet participating in the program operated 34,629 miles between unscheduled roadside breakdowns, similar to Q2 2020. The truckload vertical sustained recent gains in miles between breakdowns, generally matching the second quarter's results and doubling the miles run between breakdowns when compared to the third quarter of 2019.

Fewer miles run between breakdowns means the frequency of unscheduled roadside repairs increased.Truckload vertical

The truckload vertical saw an increase in mechanical roadside repairs for the first time in a year. In general, the truckload vertical has fewer miles between breakdowns due to the nature of those operations, which see trucks return to company shops less frequently. The most expensive repairs among the truckload vertical were for the clutch system (VMRS code 023) at an average of $1,000 per repair, the cooling system (VMRS code 042) at an average of $704 per repair, and the charging system (VMRS code 031) at an average of $676 per repair.

While not all participating fleets operate refrigeration units, mechanical refrigeration unit repairs (VMRS code 082) may have contributed to the increased truckload vertical repair costs in the third quarter, the report noted. The average MRU repair for the third quarter cost truckload carriers $644. When MRU expenses are removed, the truckload vertical's average cost per mechanical repair falls to $369.

The best-in-class truckload carrier ran 35,906 miles between breakdowns during Q3. The average for the vertical was otherwise 23,223 miles between breakdowns.

Less-than-truckload vertical

The less-than-truckload (LTL) vertical again experienced the highest cost per repair at $642, which appears to be driven by a few high-cost and high-frequency repairs for that vertical. Two of the LTL vertical's top five VMRS systems repair – Power Plant (VMRS code 045) and Cranking System (VMRS code 032) – carried significantly higher cost per repair at $732 and $545, respectively.

For Q3 2020, the LTL vertical ran fewer miles between repairs than averaged in the second quarter at 47,622 miles on average, but was generally in line with the third quarter of 2019.

The LTL vertical's best-in-class fleet ran 35 percent more miles between breakdowns at 64,107 miles between breakdowns.

Tank vertical

A number of new tank fleets entered the Benchmarkit study during the first quarter of 2020, which may account for the increase in breakdowns for the vertical in 2020.

The best-in-class fleet in the tank vertical ran 43,859 miles between breakdowns compared to the vertical average between breakdowns of 20,115 miles.

When it comes to mechanical repairs, excluding tires and towing, tank fleets spent $420 on average per mechanical repair, a 21 percent decrease in cost compared to the same quarter in 2019.

The top five VMRS systems repaired account for 78 percent of all unscheduled roadside repairs for the tank vertical. Only lighting systems (VMRS code 034) experienced an increase in miles run between repairs. According to the Q3 2020 report, the tank cohort saw the largest amount of roadside repairs due to tires (VMRS code 017) and exhaust systems (VMRS code 043).

The American Trucking Associations (ATA) Technology & Maintenance Council (TMC) and FleetNet America presented its most recent executive summary of unscheduled roadside repairs. The data provided insights on unexpected roadside breakdown costs for the truckload, LTL, and tank industry verticals from July through September (Q3) 2020.

The program is a compilation of data from participating fleets to determine the frequency and cost of commercial truck roadside repairs.

The Benchmarkit program is designed to help fleets understand the frequency of roadside failures, providing a comparison to other similar fleet operations. This program helps maintenance personnel identify opportunities to improve operations and reduce maintenance expenses.