Supply chain delays, inflation, labor shortages, and the potential of a recession continue to challenge truck OEMs, equipment manufacturers, and upfitters, but fleet demand remains strong. This is making for an uncertain—but still positive—work truck market heading into next year, as Steve Latin-Kasper, NTEA senior director of market data and research, explained in a recent mid-year update.

Although the industry is still grappling with supply chain delays from 2021, work truck industry shipments have increased by about 1,500 from 2021 into 2022. Overall, this growth is expected to continue, albeit incrementally, into 2023, although it is not likely to reach pre-pandemic ‘normal’ levels for a few years, as Latin-Kasper detailed.

[Editor's Note: Latin-Kasper predicted last July that following a "fair amount of volatility," GDP would return by the second half of 2022. This relied on $65/barrel price for oil; the BRENT crude price is $109/barrel (as of July 29, 2022).

Furthermore, economists did not foresee back in 2021 that inflation would hit a 40-year high of 9.1% in June 2022.

“Some economists are expecting greater than 3% inflation—this could end up being one of the defining issues of what has an impact on our potential for growth going forward,” Latin-Kasper said in July 2021. “Inflation is a con right now, but most economists think it's temporary.”-JH]

Broadly, U.S. GDP faces the opposite outlook. After an initial downturn in 2022, NTEA now projects a 4.8% rally before seeing a slow but steady downturn through the rest of 2022 and into 2023, according to Latin-Kasper. But this doesn’t mean that there is clarity among economists on the direction of the forecast.

“While consensus panels are normally pretty closely aligned with each other, you have some consensus panels like Wells Fargo out there …who are predicting recession," Latin-Kasper said. “But a number of other consensus panels, they, like me and S&P, are continuing to forecast slow growth, but not a recession.”

[Editor's Note: After Latin-Kasper's comments, the U.S. Bureau of Economic Analysis released an advanced estimate of Q2 2022 GDP data, which showed a 0.9% decline. If accurate, this would be the second straight quarter of negative GDP growth, with GDP down 1.6% in Q1 2022. Prior to the current U.S. regime, two consecutive quarters of GDP decline indicated a recession.-JH]

Chassis, vans, trailers

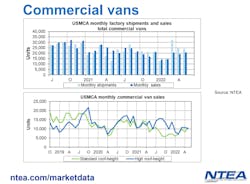

While the overall CV industry continues to recover from the pandemic downturn, the data for light-, medium-, and heavy-duty trucks is varied. Supply chain problems are still negatively impacting all three segments; however, shipments are expected to improve for Classes 2-7. But the commercial van market has plenty of room to grow into 2023, as shipments have outpaced sales since the same period in 2021.

“We expect to see both [standard and high roof-height commercial van sales] continue growing slowly as we go through the second half of 2022,” Latin-Kasper advised.

Producer prices

Producer prices are largely expected to rise across the board, save for aluminum, which will decrease due to increasing production in China. Both Russia and China are key players in the rise and fall of steel sheet and plate production pricing, and the ongoing conflict in Ukraine and the economy of the European Union will also influence prices as the year continues.

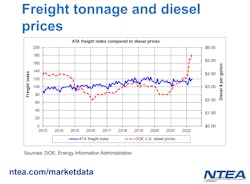

Diesel prices

Similarly, the volatility of diesel prices is expected to continue due to the European Union’s restructuring of its energy infrastructure, further exacerbating the backlogs in fleet and supply chains with the increased cost of fuel. The NTEA does not expect stability to return any time soon as DOE U.S. diesel prices currently outstrip American Trucking Associations’ Freight Index by $2.

“When freight is not growing as fast as the cost of diesel is, you end up with them having difficulties staying on budget for everything else, including trucks and truck equipment,” Latin-Kasper said. “Prices are likely to remain high in a relative sense as we go forward. And that could get worse at the end of the year instead of better as the EU continues to restructure its entire energy sector.”

Leading indicators

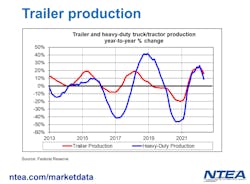

With rising inflation also contributing to fuel costs, NABE and S&P forecasts anticipate a continued decline in housing starts, average prime rates of interest, and business and heavy-duty truck production. As opposed to some forecasters and media, Kasper emphasized that this wasn’t an indication of an immediate recession but instead could predict a recession in about a year.

In support of this theory, the NTEA has noted flat to slow growth among chassis OEMS, not due to lack of demand but more because of the continuing supply chain and labor shortage issues. However, the slow pace of growth is not congruous across the board, as Classes 2, 6, and 8, as well as tractors, have still displayed relatively strong growth through the current year and are expected to continue to do so throughout the next.

Overall, Kasper’s analysis outlined that the commercial vehicle industry is strong in terms of credit availability, quoting activity, expenditures, and demand. But these assets are running into problems in terms of backlogs in chassis availability, input shortages, inflation, and long-run labor market imbalances.

Additionally, COVID-19 and international and national political complications continue to make forecasting difficult.