Manufacturers of cars, trucks, appliances, and phones struggle to acquire the essential components to complete the products that drive the U.S. economy and create the freight that keeps trailers full and trucking in demand. An improved supply chain would lead to an economic boost in 2022. But when in 2022?

“We’ve been stuck for nine months,” said Don Ake, FTR's VP of commercial vehicles. “We know that the supply chain is going to unclog at some point—we don’t know when—and that’s going to determine what number you get for 2022."

While the trucking industry faces a much-publicized driver shortage, there also is a growing new truck shortage. Slowed by a clogged supply chain of components, truck OEMs are poised to rebound as that supply improves in 2022, Ake said during FTR Transportation Intelligence’s quarterly webinar on trucking, the economy, and commercial vehicles.

See also: ATA’s Costello: Freight will remain strong in 2022

While the CV market—and many of the U.S. and trucking economies—is helped by an improved supply chain, indicators show that vehicle build rates should increase each quarter of 2022, Ake said. FTR also anticipates GDP to continue with steady growth nearing 5% per quarter through the first half of next year.

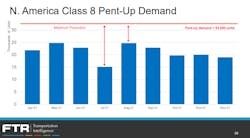

“Once we get through this, you’re gonna see strong production rates up for an extended time,” Ake said. “You’ve got the standard demand that our model is showing, you’ve got pent-up demand that can get built this year. You had pent-up demand last year—a little bit that rolled into this year. So you’ve got the demand.”

But, Ake said, the U.S. is still in the “worst supply chain/shortage environment since World War II.” And there are inflation worries on the horizon that could affect the consumer spending that has kept the U.S. economy—and trucking rates—going during most of the pandemic.

Consumer spending drives the pandemic economy

“The consumer sector continues to lead our economic recovery,” according to Avery Vise, FTR's VP of trucking. “That's hardly surprising given the unprecedented levels of consumer stimulus provided over the past 18 months or so. And also the limits on how consumers could spend that money during large periods of time during the pandemic.”

Retail sales have been picking up the later part of 2021, hitting a record level in October, Vise said. “Overall, it’s very strong, and it’s also resulted in very lean overall retail inventory.”

Vise called the industrial sector “another story.” While demand is quite strong, output has “barely recovered,” he noted. Orders for manufactured goods, core capital goods, and durable goods—excluding transportation equipment—are at record levels as 2021 nears its end. Industrial supply chain challenges, particularly semiconductor shortages, have impacted motor vehicle and parts manufacturing, Vise said.

Ake said this situation leading into 2022 “is kind of replay of 2021: Things have to break loose at some point.” He said the amount of production in 2022 is limited not only by the supply chain but also by the labor supply.

“So we’ll see how the supply chain performs when it’s open—when it’s still pressed,” Ake said. “Those suppliers are going to have to operate at a high level for the entire year with limited disruptions and issues. We think that can happen—but we’ll still be talking supply chain one way or another for a couple of years.”

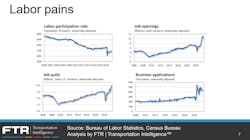

Labor market another challenge for economy

The labor market “is a big part of the challenges the economy is facing—and likely will face going forward,” Vise said. “The good news is we've seen solid job growth recently in payroll employment.”

The day after Vise spoke, the government announced that the U.S. added 210,000 non-farm jobs in November, which brought the unemployment rate to 4.2%. Before the pandemic, unemployment was down to 3.5% in February 2020.

Employment in transportation and warehousing increased by 50,000 in November, bringing it higher than its February 2020 level, according to the Bureau of Labor Statistics. The more than 6 million people working in that broad category is up 8% compared November 2019 (5.59 million).

Truck transportation jobs this November are about even to what the BLS reported November before the pandemic: 1.51 million in 2019, 1.52 million in 2020, a 0.6% uptick. This subcategory covers various jobs in trucking, not just drivers.

But Vise noted, before the latest numbers were released, that there were still fewer truck freight CDL drivers employed in September 2021 than before the pandemic. Some categories within transportation employment are doing better than others.

While most are still down, local general freight is one of the few truck driving jobs that has recovered beyond pre-pandemic levels. “It shouldn’t be a surprise that local is up,” Vise explained, “as it is almost certainly a bleed-through of the ecommerce demand we’ve seen and final-mile demand we’ve seen.”

Couriers and messengers, which covers local delivery, such as final mile and parcel delivery, has 40% more working these jobs this November (1.10 million) compared to 2019 (784,200). These last-mile delivery jobs, many of which do not require a commercial driver’s license for entry, have been driven by the pandemic-transformed American consumer.

Consumers and inflation could control 2022

How consumers make, save, and spend money will help determine the 2022 economy.

While 2021’s Q3 “was weaker than expected for GDP, we forecast solid growth next year,” Vise said. “By the end of the year, we’ll see that growth taper off to what was the high-side of normal prior to the pandemic. But we should have a solid 2022—unless some of the risks that we see as downsides all come into play.”

It was an even weaker period for GDP Good Transport, the segment of the economy tied to freight transportation. “The third quarter was not just weak, it was actually negative quarter-over-quarter,” Vise said. “We had not seen that happen since the contraction in Q2 of last year.”

Vise did chalk some of this up to “one-time or unusual” factors, including Hurricane Ida’s impact on industrial production in the South and “unimpressive consumer spending” during the first two months of Q3.

“But based on the data we have so far, Q4 is looking stronger,” Vise added. “As we look ahead, we still have plenty of pent-up demand in the goods transport sector,” presuming job growth and industrial sector growth continues.

The weak 2021 Q3 represented the weakest quarter since 2020’s Q2, the COVID-19 pandemic’s first full quarter. But Vise and the analysts at FTR expect a solid rebound to round out 2021. “We certainly can see some volatility as we move forward due to supply chain issues—especially the semiconductor shortage. But we will mostly see solid growth this quarter and in 2022, especially for the first three quarters as the overall economy starts to taper back down to a more normal level of growth,” he explained.

Vise sees the upside risk in the semiconductor shortage. “There's clear pent-up demand for cars, trucks, and SUVs,” he explained. “Even if there weren't, auto inventories are so depleted that there's going to be upward pressure on auto production well into next year and possibly into 2023. Barring, of course, an absolute collapse.”

This hopeful look into the future does include several risk factors, Vise cautioned. Much of that risk comes in the consumer sector, which has shown the most strength in 2021. “We are seeing the strongest inflation in 30 years,” Vise said. “Some of that may be temporary—but it’s certainly sticking for now and that has an impact in reducing consumer buying power.”

Vise said it’s possible that retail sales reached record levels in 2021 because prices went up. “It doesn't take away from the fact that it was very strong, even if you take pricing out of it, but certainly inflation is a potential concern in terms of buying power,” he said.

This time last year, millions of Americans were receiving extra federal and state unemployment benefits and were expecting a second COVID-19-related stimulus check in the new year. Enhanced unemployment benefits are over. Later this month, federal child tax credits, in place since July, will end.

Americans’ personal savings rate is nearly returned to pre-pandemic levels, which Vise said doesn’t mean consumers don’t have savings. “But since their monthly cash flow is basically back to normal, they might not spend it,” he explained.

With warehousing an important part of the booming ecommerce business model, if the economy is held back in 2022 and Americans stop spending, sales-driven inventory could be impacted. “We might end up with considerably more inventory than we need and that hass some potential downside for the market,” Vise said.

This article originally appeared on FleetOwner.com.