Trucking economist Dieli says economy still 'recession eligible' in 2025

GRAPEVINE, TEXAS—At MEMA’s Heavy Duty Aftermarket Dialogue on Jan. 20, MacKay & Company’s chief economist, Dr. Robert F. Dieli, strolled up to the stage to Darth Vader's signature anthem “The Imperial March” blaring over the Gaylord Texan auditorium speakers. It quickly became apparent why: the economy may still be pulling toward the dark side.

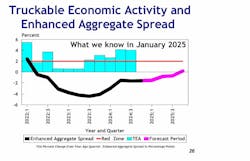

While experts have predicted a positive economic turnaround this year, Dieli's models forecasted that the economy is in what the chief economist calls a "divot" and still "recession eligible."

As he pointed to his chart, he said "every divot that the model has produced since 1970 has had one, if not two, recessions in it."

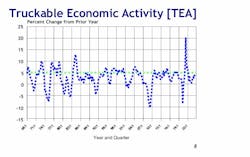

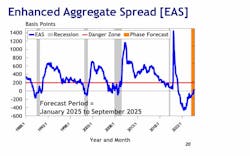

Dieli based his analysis on two main metrics: The Truckable Economic Activity (TEA) and the Enhanced Aggregate Spread (EAS). TEA works as a report on the main economic segments that support the trucking industry, while EAS considers treasury note yields, the federal funds rate, inflation rate, and short-term unemployment.

“We have found that when TEA is tracking it 5% or better, what we hear from you or the rest of the trade press is that conditions are good,” Dieli noted in his presentation. “You'll notice that we are below 5% and have been below 5% for quite a while.”

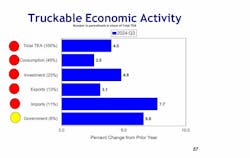

The factors that most impact TEA include U.S. consumption, investment, exports, imports, and government spending, with exports and imports growing in market share (up to almost 22%) in the last few years.

Meanwhile, the EAS, Dieli said, has functioned as a solid predictor for recessions, with every drop, or “divot” in this report usually coming with 1-2 recessions since 1970, or as far back as MacKay has used this metric.

And he said we are currently in a divot, thus making a recession possible.

By combining both TEA and EAS rates, this can provide a more holistic picture of where the trucking industry is headed going into 2025. But according to Dieli, the industry isn’t out of the woods yet.

Key indicators for TEA

Part of what’s putting the TEA in a questionable position for Dieli is how key segments of the indicator are underperforming, with the expectation that segments performing above 5% are doing well, and those beneath are not.

Read more: HDAD 2025: Fleet executives share that finding skilled technician, reliable parts still a challenge

According to MacKay, only the government and import indicators are doing generally well, but those elements only comprise 18% of TEA overall. Why each sector is struggling or succeeding is based on various elements which Dieli summarized by sector:

- Consumption is struggling with a softening labor market, slow income growth, and the effects of inflation on spending

- Investment is hurting from high interest rates, weak profit growth, and regulatory uncertainty

- Government spending is expected to do better due to the Department of Government Efficiency, policies in Project 2025, the debt ceiling, and state and local revenue growth

- Exports are fighting the high U.S. dollar, which is hurting our competitiveness in the export market, weak foreign demand, and ocean shipping issues

- Imports could struggle due to potential tariffs and ocean shipping issues

Tariffs, in particular, were a large part of the economic conversation at HDAD, largely because how they are implemented can be varied and there’s no way to predict when and how they’ll go into effect. Yet if they’re implemented, Dieli was very frank about their impacts on the industry.

“It was already mentioned by several panelists earlier that they would feel no problem at passing the cost on to the consumer, this will show up on producer price index, but eventually the super pricing index,” he warned.

Other economic monitors

But Dieli didn’t just base his analysis on the TEA and EAS. Additionally, he delved into other trucking industry monitors, such as truck transportation employment, fuel costs, truck transportation services, and Class 8 truck sales. For employment, Dieli noted that general employment has been decreasing roughly since 2022, with a particular dip due to Yellow Freight going out of business.

“Going on almost three years, the employment situation has been flat,” he explained. “And typically, when you're not hiring, it's because you're not moving from freight.”

Similarly, the U.S. decline in retail diesel prices reflects how the trucking industry hasn’t been moving as much freight, and thus buying less fuel. Similarly, he noted how truck transportation services and Class 8 retail sales have also been flat or declining.

“As you can see, those numbers represent the distance between the peak in sales and the next business cycle,” Dieli noted. “These elements have been forecasting the recessions that the model told us we were liable to have during that period.”

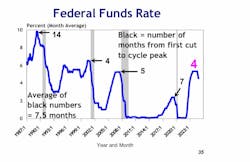

Finally, one of the largest economic monitors Dieli considered was federal interest rates. According to the economist, it’s possible to gauge the advent of a recession based on when the Fed cuts interest rates.

“We're four months past the last cut,” he noted. “The average of those numbers is seven months. I'm thinking that if we're going to have a cycle, it'll be in the first half of the year, there's this cycle model that is going to prevail.”

Taking all of these factors into account, Dieli’s final conclusion for the trucking economy was simple: “2025 will be a challenging year.”

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.