Economy, lawsuit abuse reform top ATRI list of fleet concerns

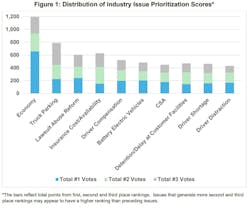

Due to a sluggish freight economy and rising operational costs, the economy was named as the top transportation industry concern for the second year in a row, according to American Transportation Research Institute. ATRI surveyed over 3,700 trucking stakeholders, including motor carriers, truck drivers, industry suppliers, driver trainers, and law enforcement, to get its annual top 10 list of concerns for the upcoming year.

ATRI Top 10 overall issues

- Economy

- Truck Parking

- Lawsuit Abuse Reform

- Insurance Cost/ Availability

- Driver Compensation

- Battery-electric vehicles

- CSA

- Detention/Delays

- Driver Shortage

- Driver Distraction

Rebecca Brewster, ATRI president and COO, unveiled the list at the American Trucking Associations’ Management Conference & Exhibition in Nashville. More than 3,700 trucking industry stakeholders participated in this year's survey, including motor carriers, truck drivers, industry suppliers, driver trainers, and law enforcement.

To download the full report, visit ATRI's site.

It's no surprise that the economy claimed the top spot again. Declining freight rates, lingering inflation, insurance, regulations, and more have all played a part. ATRI research indictaed over the past two years, fleet operational costs rose by 22%.

Suggested remediation strategies to improve the economy include reforming/repealing regulations that don't provide a benefit and renewing the 2017 federal income and corporate tax cuts, which are set to expire next year. The Tax Cut and Jobs Act lowered the corporate tax rate from 39 to 21%. If elected on Nov. 5, Donald Trump would certainly push for a new slew of tax cuts. If the electorate names Vice President Kamala Harris the winner, the average top tax rate on corporate income would be 32.2%, according to The Tax Foundation.

Truck parking remained in the No. 2 spot year-over-year, while lawsuit abuse reform jumped three spots to the No. 3. Specifically for motor carriers, tort reform was the second biggest concern after the economy. In fourth place was insurance costs and availability, which have increased because of nuclear verdicts and overall increases in settlements. State caps on damages and the elimination of phantom damages to cover bloated medical bills were two solutions suggested to help alleviate the out-of-control costs.

Battery-electric vehicles (BEVs) moved up from tenth place to sixth over concerns regarding the total cost of ownership and emergency response to collisions. A now infamous study from Roland Berger found electrification will cost the industry $1 trillion over the next 15 years, with an estimated $594 billion going to vehicle costs. ATRI will examine how repealing the Federal Excise Tax could impact BEV adoption and the Federal Highway Trust Fund, which the FET money goes toward. More than a quarter of ATRI survey respondents also pointed out that crash response must also be quantified. Once they ignite, trucks’ massive lithium-ion batteries are incredibly difficult to douse; as demonstrated by a recent Tesla Semi fire in California that required 1 million gallons of water to put out, closing the highway for 16 hours.

Two top issues from last year, fuel prices (No. 3 in 2023; No. 1 in 2022) and driver retention (No. 8 in 2023) did not make the cut. They were replaced by the federal Compliance, Safety, and Accountability program (No. 7 in 2024), and the aforementioned insurance costs.

Though it has not made the overall top 10 since 2021, the diesel technician shortage rounded out the motor carrier top 10.

ATRI Top 10 Motor Carrier Concerns

2023 rank in parentheses

- Economy (1)

- Lawsuit abuse reform (3)

- Driver shortage (2)

- Insurance cost/availability (6)

- Driver retention (5)

- CSA: Compliance, Safety, and Accountability (not ranked)

- Truck parking (8)

- Battery electric vehicles (7)*

- Driver distraction (10)

- Diesel technician shortage (9)

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.