Market insights with Mike: Pandemic impact and outlook on the auto care industry

Passenger Travel Update

In our inaugural piece, we highlighted trends in vehicle miles driven and launched a survey to learn about the impact of COVID-19 on the aftermarket. Survey results are highlighted below (click here). Traffic continues to stay at nearly 50 percent below their levels in late February. INRIX reports that the drop in vehicular traffic has flattened a bit in recent weeks – as pictured below, passenger travel was on average 48 percent lower during the week of April 4-10 than the week of February 22-29.

According to INRIX, the trips have averaged from 8.70-9.40 miles, comparable to the control week (February 22-29) value of 9.11 miles.

We know that VMT is just one of many data points that can help your business navigate current uncertainty. As a result, we’ve decided to offer free access* to 40+ Economic and Industry Indicators to our interactive industry research platform TrendLens. Sign up to access it here.

COVID-19 Impact

We’ve received more than 140 responses to the survey about the pandemic’s impact on your business – thank you for taking the time to participate. We’ll be reporting results over the coming months, so please take the survey from time to time (e.g., monthly) and share it with your colleagues so that we can track the results and share them with this community and with federal and state government leaders. There is “strength in numbers”, and your input will help us advocate for the industry.

Responses are primarily from smaller companies (half have 1-100 employees, one-fifth have 101-500 employees) in manufacturing (35 percent), business services (16 percent), and warehousing/distribution (15 percent).

Overall, COVID-19 is having a substantial impact on the business performance, investments, staffing, and demand for products and services for companies across the aftermarket, regardless of size or business type. Due to imminent concerns of financing day-to-day operations, aftermarket companies are aggressively managing their business operations to capture government assistance, shorten payment cycles, operate leaner, shorten work schedules, and reduce spending. While not hopeless, the outlook for the future leans negative, and most expect the pandemic’s impact to last at least 3 months.

We show frequency of response for selected questions below – in our next edition, we’ll compare results across survey waves.

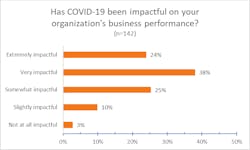

Nearly two-thirds (62 percent) of aftermarket organizations are experiencing a substantial impact on their business performance:

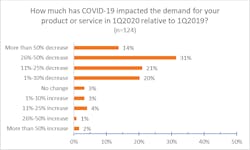

Six out of seven aftermarket organizations (86 percent) reporting that COVID-19 has been at least “somewhat impactful” on business performance are seeing a decrease in demand for the services/products, with nearly half (45 percent) seeing a decrease of at least 26 percent. Several organizations in business services, manufacturing, and warehousing/distribution are experiencing an increase in demand.

Note: Question asked of those responding “Somewhat”, “Very”, or “Extremely Impactful” to “Has COVID-19 been impactful on your organization's business performance?”

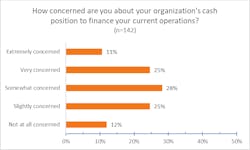

Keeping operations running is a real concern: one-third of aftermarket companies are “extremely concerned” (11 percent) or “very concerned” (25 percent) about their organization’s cash position to finance their current operations.

To address this, management is launching a holistic response – sample comments are below.

- Staff adjustments, expense adjustments, applying for a payroll protection program.

- Paying close attention to [Accounts Receivable], having weekly meetings between sales and accounting. Working together to collect. Offering additional payment discounts for slower paying customers.

- Hiring Freeze; benefit cuts on 401(k) matching; dropping contracted services; eliminating all overtime; re-negotiating all contracted levels of service contracts; freezing bonuses and pay increases; cutting all non-essential expenses; selective terminations.

- Executive pay cuts, temporary layoffs, 4-day workweek.

- Have applied for everything [the state] and the [federal government] has offered. Had a few layoffs and a few furloughs, major cut on spending, and holding back on certain payments.

- Applying for government loans.

- Not negotiating extended terms for customers. Mandated each salary employee take 5 vacation days in the month of April. Defer payments to our suppliers 60-90 days.

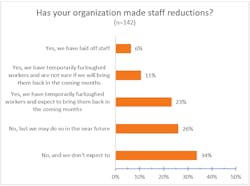

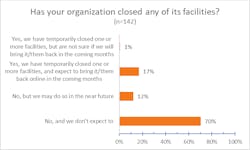

Two out of five aftermarket organizations have laid off or furloughed workers (40 percent), and one out of six has closed a facility (18 percent). The depth of staff cuts through mid-April has spread the range: half of the companies (51 percent) have laid off/furloughed 21 percent or more of their staff:

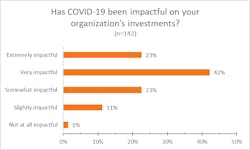

In line with the results noted above, the pandemic has highly impacted the investments of two-thirds of aftermarket organizations (65 percent Top 2).

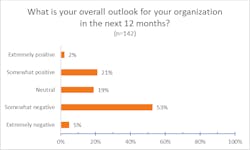

Not surprisingly, the overall outlook for the next 12 months leans negative:

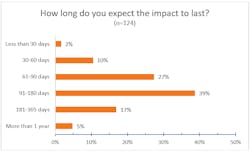

Three-fifths of aftermarket companies (61 percent) reporting that COVID-19 has been at least “somewhat impactful” on business performance expect the pandemic’s impact to last 3 months or longer.

Note: Question asked of those responding “Somewhat”, “Very”, or “Extremely Impactful” to “Has COVID-19 been impactful on your organization's business performance?”

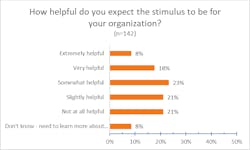

As far as whether the economic stimulus will be helpful, views span the range regardless of business type and company size.

We encourage you to take this survey each month so that we can track results over the coming months – we’ll share the results in this channel, and advocate for the government to support the industry as much as it can.

Information provided by Auto Care Association