TechForce adjusts technician demand projections by 20%

Wrapping up 2024, the TechForce Foundation estimated that 971,000 total auto, diesel, collision, and aviation technicians will be needed between 2024-2028 in their most recent Supply & Demand Report. This is a nearly 20% increase from the non-profit’s projections from last year. This is despite the number of postsecondary technician grads and overall employment numbers increasing across all sectors. Last year, the organization pulled back and said the industry would need 795,000 entrant technicians over the next few years, instead of the nearly 1 million they anticipated in 2022.

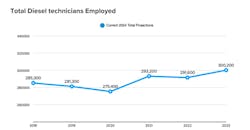

The employment rate for diesel technicians specifically reached its highest point in the last five years (300,200 technicians in 2023, a 3% increase from last year), so why has the organization’s demand projections increased again?

It's because while diesel technician employment rates are going up, growth overall has been slow. According to the non-profit, the industry has only added 15,000 technicians from 2018-2023, representing a total increase of 5.22% and a 1.04% gain per year.

Another reason this growth has been so slow is that replacement positions due retirement and turnover in the diesel sector are still outpacing new positions due to growth. The Supply & Demand report found there are more replacement positions than new positions at a rate of 4:1, especially due to 46,695 unfilled positions carrying over into 2024 from 2022 and 2023. With these unfulfilled positions included, there was a total new entrant demand of 80,618 for 2024, with 12% of that demand coming from new positions, and 30% coming from replacement positions.

“This year’s Supply & Demand Report shows that progress is being made in filling the jobs pipeline, but also demonstrates a bottleneck in workforce development," said Greg Settle, the report’s author and director emeritus at TechForce. "Closing the gap between technician demand and supply requires an ‘all-hands-on-deck’ approach, with collaboration among industries, policymakers and educators at every level.”

Here's a look at the diesel tech replacement versus new postion growth:

And the need for replacement technicians is only projected to grow, with over 33,000 techs needed by 2028. And this is all despite the U.S. Bureau of Labor Statistics finding that the replacement rate for diesel techs dropped from 8.2% to 8.1% in 2023, meaning that the number of exits from the industry is still decreasing.

Read more: Shops failed their techs in 2024 but can fix that in 2025

But the report still noted a higher projected demand for diesel technicians from last year.

“What is very apparent is the significant increase in projection numbers for 2024,” TechForce’s Supply vs. Demand report noted. “This is due to the trend of relatively low annual increases in the diesel tech population, and particularly in 2022-2023, when the projections were for 55,000 new techs needed, but only 8,600 were added.”

The diesel technician pipeline

There is some hope for the diesel industry in the growing amount of students completing technical programs. Since 2021, the number of diesel students has increased, with 11,310 diesel tech students completing their programs in 2023, a 5% increase from 2022.

Both two-year public and private for-profit schools delivered the bulk of these completions, with public, two-year schools graduating 5,843 students in 2023, and private for-profit schools graduating 2,912. As was the case in 2022, the total amount of public-school graduates (7,646) dwarfed private graduates (3,665), due to how there’s a greater ratio of public schools than private at a rate of 31:4.

However, TechForce did find that private schools did tend to have a higher average number of graduates per year per school, with 112 graduates versus public institutions’ 32.

WyoTech was the largest diesel institution in 2023, with 476 completions. They were followed by the University of Northwestern Ohio (291), the Universal Technical Institute of Arizona Inc. (254), the Gateway Community and Technical College (195), and the Texas State Technical College (176).

“As an organization that — together with our donors and partners — works to correct the imbalance between technician supply and demand, it is encouraging to see continued growth in the number of graduates preparing to step into technician careers," said Jennifer Maher, CEO of TechForce. "The report demonstrates that our efforts are making a difference, but also highlights the critical need to further strengthen the pipeline by supporting entry-level technicians through scholarships and workforce development programs, ensuring the demand for talent is met.”

To assist these schools in meeting the diesel technician demand, TechForce advocated that the industry continue to invest in their talent and institutions in ways that may be very familiar by now. These include:

- Engaging with students and cultivating awareness of the trades beginning in middle school through high school

- Cultivating relationships with technical school instructors and administration via donations, visits, training aids, and advisory boards

- Building awareness of technical career opportunities with students, parents, school faculty, and admin

- Providing internships, mentorships, and apprenticeships to “grow your own” technicians

- Encouraging enrollment in post-secondary training programs

- Helping fund technical scholarships

- Providing support for nonprofits working to address the technician shortage