An uneasy freight market and weak spot rates likely are having the effect of driving more operators out of business, but the equipment they are surrendering to the used-truck market is benefiting sales and the quality of the commercial equipment that is entering the market, according to recent reports.

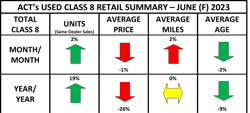

ACT Research weighed in this week with new data on improved Class 8 retail sales from June, adding to “uncharacteristically high” sales numbers that the trucking industry researchers at ACT released in May.

The two months collectively show that, considering soft economic and freight environments and stagnant spot and even contract rates for current freight haulage, the used market is benefiting from carrier exits from the industry, especially by owner-operators and smaller fleets, according to ACT, which was backed up by data gathered by analysts at FTR Transportation Intelligence.

Retail sales in June were up 1.8% over May. And in May, volume improved 12%, a month when they usually slow 4% to 5%, ACT said in a release a month ago, “presenting a bit of a conundrum in the context of the current economic and freight environments, said Steve Tam, VP at ACT.

“As owner-operators and smaller fleets in particular exit the industry, inventory continues to increase. This is providing remaining fleets with more options than they have had in a long time,” Tam added then.

ACT did not report on the auction market for June, but in May auction sales increased 32% compared to April. Combined, the total market swelled 13% month-over-month in May, and compared to May 2022, the retail market was 17% larger, Tam said. “The auction and wholesale segments also expanded, 43% and 79%, respectively. Their combined performance drove the total market 31% higher” over a year ago.

With ACT’s July 26 report on the June sales volume, Tam added: “Sales usually increase 4%-5% in June, so the increase was not unexpected in that regard. However, in the context of the current freight market, and amid all the press regarding fleets going out of business, it may seem a little counterintuitive.”

“The reality is that there is a net decline in the number of fleets with operating authority, but it is important to remember fleets are both entering and exiting operation daily,” he added. “It is, in part, that churn that is driving the better-than-expected sales volumes. In addition to the churn, more inventory is affording carriers an opportunity to refresh their fleets with younger used trucks.”

Spot rates, fleet exits influencing used truck market

Independent data from FTR points to the type of dynamics at play on the used-truck market that ACT’s Tam cited.

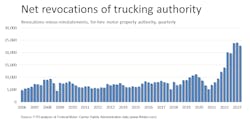

Net “revocations of operating authority” at the Federal Motor Carrier Safety Administration, meaning fleets that have folded or their owner-operators have given up their own required FMCSA authorities to move on and leave trucking or drive for other carriers, were down slightly in the second quarter of 2023 but not much off the record pace of revocations set in Q1, Avery Vise, FTR’s VP of trucking, told FleetOwner on July 28.

And new FMCSA authorities, carriers or owner-operators that might be entering, declined “somewhat more sharply” in Q2 (17,680) compared to Q1 (19,631), meaning fewer new operators are entering trucking to replaced the ones that have been lost or are driving elsewhere, Vise said, citing FTR-gathered data through June. Elevated revocations plus fewer new authorities meant that the net decrease of 5,111 in the carrier population in Q2 set a record, he said.

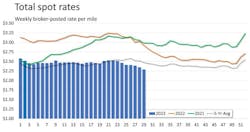

What’s causing more operators to exit trucking or seek shelter with larger trucking companies and therefore sell or surrender their trucks? If owner-operators were asked that question last year, they would have answered rates on the spot market and the cost of fuel. But the cost of diesel and gasoline has fallen, diesel off $1.363 a gallon from a year ago, and gas down 73.7 cents, according to the latest government data, even though both fuels rose last week. But the spot market is still in a trough, according to FTR data through July 21 with its partner on Spot Market Insights, load board Truckstop.

According to the weekly FTR/Truckstop report, the total broker-posted rate on the spot market declined about 6 cents for the eighth straight weekly decrease. "The total market rate was nearly 22% below the same 2022 week and more than 7% below the five-year average. Rates are still moving in a seasonal manner, but they had been holding close to the five-year average until June. Once again, the total market rate in the latest week was the lowest since August 2020," according to the report.

Total load activity also declined 6.7%, and volume for the week ended July 21 was 36% below the same week last year and about 27% below the five-year average.

Another volume index for June, fed by data from DAT Freight & Analytics, signaled that spot rates have hit bottom, so making a living off spot rates is still difficult for operators. And even contract rates have hit their lowest points in two years, according to DAT.

The article "Fleet failures playing role in fueling used-truck market surge" originally appeared on FleetOwner.com, an Endeavor Business Media partner site.