What’s up with low rolling resistance tires?

When it comes to reducing heavy duty truck greenhouse gas (GHG) emissions and improving fuel efficiency, tires play a key role. Specifically, fleets may consider specifying low rolling resistance (LRR) tires in order to lower emissions and fuel consumption

Rolling resistance 101

Rolling resistance is the friction or drag created between the tire interacting with the road while the vehicle is in motion. Tires with lower rolling resistance, often denoted as LLR, create less drag.

“The lower the rolling resistance, the less fuel consumed,” says Pat Meisenholder, product technical manager for tire producer Michelin North America. “It is estimated that a third of heavy duty truck fuel consumption is used to overcome rolling resistance.”

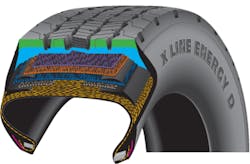

There are a number of factors that categorize tires as low rolling resistance. Tire manufacturers are working to create next-generation tire compounds to assist with extending the wear and retreadability of tires.

“The tire’s rolling resistance can be changed many different ways including changes to the rubber compounding, tire shape, tread pattern, tire construction, and weight,” explains Phil Mosier, manager of commercial tire development for Cooper Tire. “The key to developing a successful product is coming up with the right combination of all these factors to get what the consumer needs.”

When it comes to tire tread, in particular, LRR tires often have a lower average tread depth. While less tread equates to less drag, it also means the tire would need to be replaced more often.

“For many tire manufacturers, that has meant lowering the starting tread depth to get better fuel economy,” Mosier says. “While that solves one problem, it creates another – fewer miles to removal and less traction.”

Sanjay Nayakwadi, director of product strategy, U.S. and Canada, Bridgestone Americas Tire Operations, advises tire manufacturers must address these needs for fleets in order to deliver a product that both meets the federal emissions and fuel efficiency requirements while also providing longevity and durability.

“[Tire] manufacturers will need to not only design tires that meet verification requirements but also tires that fleets will be happy with as they watch their bottom line and expect more out of their investment,” Nayakawdi says. “As tire manufacturers work to achieve the right combination of durability and efficiency, it’s important for fleets to consider tread wear needs, traction requirements, and the application of their tires from a holistic point of view.”

SmartWay verification

Launched in 2004, the U.S. EPA’s SmartWay program certifies products that assist with saving fuel and reducing emissions. This includes, but is not limited to, tires.

When it comes to SmartWay verification criteria, Bridgestone’s Nayakawdi notes the program considers tire size, tread depth, performance, and testing requirements. “All SmartWay-verified tires offer low rolling resistance,” he adds. “However, just because a tire claims to be low rolling resistance doesn’t mean it’s SmartWay verified unless it’s been through the official testing and verification process.”

As it relates to tire SmartWay certification, a tire must reduce greenhouse gas emissions and fuel consumption by 3 percent or more, compared to the best-selling tires available on the market for similar applications. Fleets looking to specify new tires, or to confirm whether current tire specifications meet these requirements, can visit the SmartWay website.

Application matters

Long haul and regional haul fleets look to benefit most from specifying an LRR tire. “The applications that run at consistent steady-state speeds gain the most benefits from fuel-efficient tires,” Cooper’s Mosier notes. Specifying LLR tires for urban applications such as pick-up and delivery, refuse collection, or jobsite applications, or any operation with extended idling times and slower speeds would not yield the same fuel economy improvements. Changes to drivetrain technology and aftertreatment systems would be required instead to address these concerns.

“A long-haul application will clearly see the benefits of a rolling resistance tire in a much shorter time span than a vocational application,” Michelin’s Meisenholder says.

As far as location on the vehicle, the U.S. EPA greenhouse gas model notes steer tires account for 16 percent of the rolling resistance contribution on a 6x4 tractor-trailer combination vehicle. The drive tires and the trailer tires both make up 42 percent of the rolling resistance contribution each. “If a user was going to try LRR tires on a given wheel position, it would be drive or trailer positions because they offer the most fuel efficiency benefit,” Mosier advises.

“Typically, trailer tires have ribbed designs that are lower in tread depth, which contributes to lower rolling resistance in this position,” Bridgestone’s Nayakawdi adds. “In addition, fuel-efficient trailer tires are designed with specialized compounds in the sidewall and bead area, which also contributes to [improved] rolling resistance.”

A durable casing is an important consideration for trailer tires, Meisenholder notes. This is because the trailer tire is retreaded more often than tires at any other wheel position.

“No matter the wheel position, a number of factors affect rolling resistance, including fleet type, load, speed, tread pattern, and tire design,” Nayakawdi says. “To help limit rolling resistance, fleets should always select the best tires for the job at each wheel position and proactively maintain them. Proactive maintenance extends the life of the tire, decreases downtime, and ultimately maximizes a fleet’s return on investment on its tire assets.”

Conclusion

When it comes to the U.S. EPA’s Phase 2 greenhouse gas emissions regulations, tires will play an integral role in reducing emissions and lowering fuel consumption.

As fleets continue to purchase late-model equipment in order to stay compliant with the Phase 2 emissions regulations, they must replace like-for-like components. This includes tire replacement.

“Greenhouse Gas Phase 2 regulations indicate that fleets must replace tires on their vehicles with equal to or better rolling resistance than what has been included on their OE equipment as manufactured,” Michelin’s Meisenholder says. “This ensures that the CO2 performance will be maintained through vehicle life. Fleets will need to work with dealers and tire manufacturers to know how to replace their tires.”

Manufacturers must include sufficient information, particularly regarding rolling resistance, in their maintenance instructions to allow end-users to purchase replacement tires that meet the appropriate performance specifications. Fleets can opt for a different tire brand or design, as long as the tire meets the same rolling resistance requirements.

According to U.S. EPA officials, if a fleet is running SmartWay-verified tires currently, they are already meeting Phase 2 standards.

It is important to make a business case for selecting tires as well. As such, fleets would do well to continue to evaluate the total cost of ownership for tires.

“As tire manufacturers work to find the balance between efficiency and durability to meet changing regulations, it will become even more important for fleets to manage their tires as valuable business assets,” Bridgestone’s Nayakawdi says. “This means proactive maintenance will become more important as fleets seek to maintain the integrity of their tire casings. If maintained properly, premium tire casings can be retreaded several times, helping to lower tire costs over time.”

“We encourage fleets to look at the rolling resistance numbers the tire has, the mileage the tire is expected to achieve, and the value of the casing,” Cooper’s Mosier adds, when it comes to tire TCO evaluations. “Compare that against the cost of the tire and then run the numbers. That will give you the cost of ownership. With this information, you’ll be making an informed decision on the best tire to run in your operation.”

Tire resource links

- Find more details about the U.S. Environmental Protection Agency’s SmartWay program at epa.gov/smartway/forpartners/technology.htm.

- Not all LRR tires are SmartWay verified. Find a list of the SmartWay-verified tires and retreads by visiting epa.gov/verified-diesel-tech/smartway-verified-list-low-rolling-resistance-lrr-new-and-retread-tire.

- Michelin offers a fuel and mileage savings calculator to help customers compare the fuel savings benefit of low rolling resistance tires against other tires at michelintruck.com/tools/fuel-savings-calculator/#/.

About the Author

Erica Schueller

Media Relations Manager | Navistar

Erica Schueller is the Media Relations Manager for Navistar.

Before joining Navistar, Schueller served as Editorial Director of the Endeavor Commercial Vehicle Group. The commercial vehicle group includes the following brands: American Trucker, Bulk Transporter, Fleet Maintenance, FleetOwner, Refrigerated Transporter, and Trailer/Body Builders brands.

An award-winning journalist, Schueller has reported and written about the vehicle maintenance and repair industry her entire career. She has received accolades for her reporting and editing in the commercial and automotive vehicle fields by the Truck Writers of North America (TWNA), the International Automotive Media Competition (IAMC), the Folio: Eddie & Ozzie Awards and the American Society of Business Publication Editors (ASBPE) Azbee Awards.

Schueller has received recognition among her publishing industry peers as a recipient of the 2014 Folio Top Women in Media Rising Stars award, acknowledging her accomplishments of digital content management and assistance with improving the print and digital products in the Vehicle Repair Group. She was also named one Women in Trucking’s 2018 Top Women in Transportation to Watch.

She is an active member of a number of industry groups, including the American Trucking Associations' (ATA) Technology & Maintenance Council (TMC), the Auto Care Association's Young Auto Care Networking Group, GenNext, and Women in Trucking.

In December 2018, Schueller graduated at the top of her class from the Waukesha County Technical College's 10-week professional truck driving program, earning her Class A commercial driver's license (CDL).

She has worked in the vehicle repair and maintenance industry since 2008.