The total cost per mile to operate a single truck hit a record high of $2.270 per mile in 2023, according to American Transportation Research Institute's 2024 Analysis of the Operational Costs of Trucking report. That's a 33% increase from 2019, when CPM was $1.669. Repair and maintenance costs rose by 3.1% to $0.202 CPM, tires stayed fairly flat with a $0.001 increase, and fuel costs went down 13%.

See the chart below for a comprehensive historical overview.

The report, which analyzes line-item costs, operations, and revenue benchmarks from various trucking sectors and fleet sizes, estimated that the R&M increases could be due to how the average mileage per truck increased in 2023 as well as a 3.4% increase in inflation. But, as is often the case, how much maintenance costs increased often depended on the size of the fleet, the age of the trucks driven, a fleet’s duty cycles, and more.

Read below for more factors that could have driven up 2023’s maintenance costs and how the ATRI anticipates these costs will looking finishing up 2024.

Younger trucks, but more miles

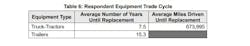

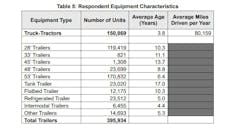

In total, ATRI’s report covered 150,869 truck-tractors and 395,934 trailers which ran over 11.97 billion miles. Of these, the report found that the average truck age dropped to 3.8 years in 2023, an “unusually low average” as a result of the aggressive truck purchasing habits from late 2022 and 2023, which was itself a response to longer average truck ages due to parts shortages from 2020 and 2021. With this, fleets are also seeing a decrease in the average truck trade cycle from 8.2 in 2022 to 7.5 in 2023.

But while fleets are returning to shorter truck life cycles, they’re also running more miles. According to the report, the average miles driven per truck in 2023 rose from 78,863 in 2022 to 80,159, even as the number of days each truck worked dropped from 251 to 243 in 2023.

This creates a clash where younger trucks might not need as much maintenance as their older counterparts, but at the same time, they’re working harder in a shorter amount of time and earning more maintenance.

Repair and maintenance costs

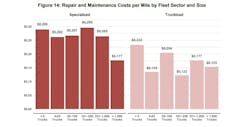

With trucks running more miles for fleets to capitalize on their newer assets, ATRI’s report also found that fleets with fewer trucks tended to spend more on maintenance, while overall, repair costs generally declined relative to the more trucks a fleet had.

While this trend was repeated across both specialized and truckload sectors, specialized R&M costs had less variation by fleet size, often with less than a cent per mile of difference.

Earlier this year, a report from American Trucking Associations' Technology and Maintenance Council’s, VMRS (Vehicle Maintenance Reporting Standards) System Service Data Quarterly Report, noted that repair and maintenance costs dropped in 2023, but only by 0.2%. Labor costs increased by 4% while parts costs dropped 2.2%.

The falling parts costs could be due to continued easing of parts supply issues and the overall soft freight market, ATRI suggested, while the slowdown of the technician labor market could play into the slower increase of labor costs.

Even with labor and parts costs decreasing, ATRI anticipates that repair and maintenance costs are likely to see another year of moderate increases due to the improved parts sourcing, less-competitive technician labor market, and the newer truck-tractors with a lower average age. To back up this assessment, ATRI said that "in the first two months of 2024, carriers reported an increase of 2% in repair and maintenance costs per mile on average compared with 2023 overall.”

More in-house maintenance and miles between breakdowns

Even with repair costs per mile increasing for fleets, ATRI did report that trucks traveled an average of 37,700 miles between breakdowns or unscheduled repairs. More specifically, truckload carriers feel below this average at 32,000 miles between breakdowns, while less-than-truckload carriers made it much further at 80,817 miles.

However, this could be due to the extreme variability in preventative maintenance from fleet to fleet, especially when considering various truck ages and duty cycles. As an example, a less-than-truckload truck with regular shifts on well-maintained highways and lighter loads is likely to make it farther without a breakdown. Meanwhile, bulk haulers using older equipment on irregular routes with heavier loads could average less than 10,000 miles between breakdowns. This emphasizes how fleets need to benchmark their M&R operational costs not just based off their sector averages, but also take into account their routes, geographic area, and loads.

Read more: Improve operational efficiency to offset cost increases

On the positive side, ATRI did note that fleets with their own maintenance programs generally had lower per-mile repair costs and greater savings. Less-than-truckload carriers did the most in-house maintenance, with 78% of these using their own shops. 55% of truckload carriers used in-house maintenance, and 48%of tankers and 45% of flatbeds also relied on their own programs in 2023.

Tire costs

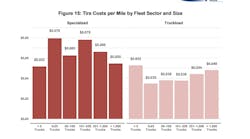

One last aspect of fleet R&M costs is specifically those attributed to tires. ATRI found that the per-mile costs for tires was nearly flat in 2023 at $0.046, barely increasing by 2.2%. According to the U.S. Bureau of Labor Statistics, this could be due to how tire component prices rose (such as those for rubber, oil, and fabric), but tire over-purchasing in 2022 as well as a soft freight market throughout 2023 helped balance these costs.

Overall, ATRI’s survey found that the tire market was steady and there was little difference in tire costs across various fleet sizes. Although typically, specialized fleets had to spend more on tires than truckload carriers, and fleets with 250 trucks or less tended to also spend more on tires due to their size and operation type.

Going forward, the research non-profit anticipated that commercial tires would keep their relatively flat price in 2024 due to supply backlogs in dealers and an overall flat demand. As an example, in the first two months of 2024, carriers saw their tire costs increase by only 1.8% per mile. However, this could change based on oil prices and global disruptions based on unrest in the Middle East and stronger storms which could interfere with oil production.