Theft is as much of a problem at vehicle maintenance and repair facilities as it is with any other organization, maybe even more so. Loss occurs not only from thieves, but from stealing by "customers" and outsiders, including vendors and suppliers, who occasionally "walk away" with the company's valuable assets, such as tools, parts inventory and equipment. And then there's stealing by an organization's own employees - a grim reality that many companies find difficult to face.

They key to reducing loss, say loss prevention experts, is to establish effective theft prevention strategies. Loss prevention is not necessarily about high-tech security, they point out, it is about making it difficult for individuals to steal. But how can you protect your business without breaking the bank? By realizing that theft and fraud is mainly due to lax hiring, misplaced trust, inattentive management and poor internal controls.

There are a great many ways an organization can decrease its susceptibility to theft and fraud by maximizing existing resources, says Michelle McHale, practice leader for the Investigative Services practice at Plante & Moran. A key approach is to create a positive environment.

Plante & Moran is one of the nation's largest certified public accounting and business advisory firms. It provides clients with tax, audit, risk management, financial, technology, business consulting and wealth management services.

"Obviously, a working environment that gives the impression that management doesn't care about its employees, or demonstrates that managers are disciplined differently than lower ranking employees, provides a motive and rationalization to commit fraud," McHale points out. "Creating an environment where honestly is practiced and employees are encouraged reaps great rewards for an organization committed to deterring fraud and theft."

HIRING METHODS

Another foundation to loss prevention is having good employees, says John Alden of GMAC's Loss Prevention department. "A comprehensive hiring approach developed with an attorney familiar with your state's labor laws can prevent the hiring of problem employees, poor performers and security risks."

GMAC is a global financial services company, initially formed to provide automotive finance products and services to General Motors dealers and clients. It has expanded its business to include mortgage operations, insurance, commercial finance and online banking.

"A written application, reference checks, credit report, drug screen, criminal background check, motor vehicle record check, an interview by the hiring manager, multiple interviews by other managers and an administrative control are the tools of the hiring process," Alden says.

McHale suggest having an outside service perform background checks on potential job candidates, as these companies are experienced in this type of work. She also advises checking educational and training degrees "to ensure that the person showing up for work is the same person who looked so good on paper."

While acknowledging that screening individuals is important, Kevin Lynch, CEO of P&L Solutions, stresses the importance of understanding the traits of a dishonest employee. "Dishonest employees may not always have a history that shows they are dishonest," he says, "but they cannot cover up the traits that indicate they are likely to be dishonest."

P&L Solutions specializes in proactive loss prevention programs to reduce shrinkage, minimize liability, improve competitiveness and increase profits and shareholder value.

WRITTEN POLICIES

Along with having good hiring practices, Lynch, McHale and Alden concur that written security policies and programs are essential in the fight against loss and fraud. These are needed for a multitude of reasons, observes Alden of GMAC. "They serve as a permanent record documenting communication on dishonesty regarding the shop's vision, expectations and day-to-day operation. This can be critical in establishing competitive image and prevents any misunderstanding."

Written policies ought to concise and strong, and clearly define improper and illegal behavior, including conflicts of interest, kickbacks, embezzlement and other improper activities, Plante & Moran's McHale adds.

"An ethics policy should be given to employees to read and sign at the time of hire, and it should be reviewed with employees at least annually, typically in a training session," she recommends. "In addition to telling employees what's expected of them, a signed ethics statement gives a company stronger legal grounds for discharging dishonest employees."

"It is very important to have written policies and programs, but the goal of these policies is not to deter theft," Lynch of P&L Solutions points out. "Policies do not deter theft. A policy gives the teeth to hold individuals accountable for their actions, which is what will help deter theft. The words on paper are only words on paper until management takes action to enforce those words."

CONDUCT CODE

Companies need to have a zero tolerance for employee theft, GMAC's Alden says, and employees need to understand that. "Every company must make it clear that they will take severe action with any employee caught stealing - including termination and prosecution," says Lynch, "and then stand behind that policy when they do catch people stealing."

"Adhere to a strict code of ethical conduct - at all levels," McHale adds. "Ensure the rules of conduct apply equally to everyone within the company. Often, especially in smaller businesses, controls aren't followed at the higher levels of management.

"Undesirable conduct can fall into many categories, from circumventing internal controls - for example, not requiring approvals on certain transactions, to seemingly harmless behaviors, such as personal use of the telephone for long distance phone calls or use of company supplies and postage for personal shipments," she notes. "Employees are keenly aware of upper management's adherence - or lack thereof - to policies and procedures.

"Leading by example is an excellent way of showing your workers what conduct is expected."

Others with whom a company does business must also know there's zero tolerance for improper business conduct or fraudulent behavior, advices McHale. "Moreover, they must be aware that any discovered evidence will be delivered to the legal and human resources departments to determine disciplinary action. Discipline must be fair, appropriate and consistent for all."

WORKER ATTITUDE

Establishing loyalty programs can have an impact on deterring employee theft, GMAC's Alden says. By establishing a sense of loyalty, the employee feels ownership and pride in the business. It is more difficult for businesses to maintain employee loyalty today, but those shops that are able to show management's interest in the employees' well being will have an advantage.

"If a program is effective in developing employee loyalty it will be effective at deterring theft," says P&L Solutions' Lynch. "Loyal employees tend to not steal."

Neither do contended workers. Worker attitude and good management helps deter employee theft as well.

"When a positive attitude exists in the workforce, including all levels of management, pride in doing the job correctly brings honesty right up front," says Alden. "Happy employees and managers tend not to steal. Therefore, it would be wise to keep employees happy - good working conditions, appreciation, training and development, advancement opportunities, etc. - so that they don't have a motivation to steal to ‘get back' at the company for some perceived or real wrongdoing."

Keeping employees happy not only helps prevent them from wanting to get back at the company, Lynch observes, "it is also helps prevent rationalizations that allow employees to convince themselves they are not stealing when they are, in fact, stealing."

Worker attitude and good managers are "the heart of preventing employee theft, he continues. "Employee attitudes will tell you more about the probability of an employee stealing than any other factor. And, that is not limited to their attitude about the workplace. Employees engage in life behaviors that are indicative of the probability of them stealing as well."

Management plays the biggest role in preventing losses in any company, and proper training is a crucial element to any loss prevention program, Lynch, Alden and McHale agree. A company can buy any security tool, device or program, but if the "management team continues to manage in the same way that encourages and allows employees to steal, you will never see a change," says Lynch.

INTERNAL CONTROLS

A recent study by the Association of Certified Fraud Examiners (ACFE) revealed that the lack of adequate internal controls was most commonly cited as the factor that allowed fraud to occur.

"Proper internal controls - a mandatory system for any company - require that transactions are properly authorized, recorded and reported, and that all assets are safeguarded, Plante & Moran's McHale says. "These safeguards include securing company assets within controlled areas; random, periodic inventory counts; new vendor verification; and review of the banking activity through online access or checking over the bank statement.

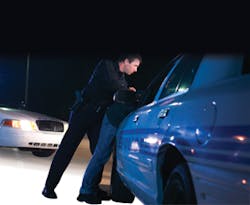

"Also, it may be warranted to install video surveillance over certain areas, such as storage areas and parking lots, to monitor activities. Since this option requires a cost to the company, verifying that the benefits will outweigh the costs is important before embarking on this endeavor.

McHale, Lynch and Alden say loss and fraud prevention requires an ongoing commitment. "It's crucial to continually think about how to improve the internal control environment and the company's ability to detect and deter fraud and theft," summaries McHale.

"According to the ACFE study, a typical company loses 7 percent of its annual revenues due to fraud - typically much more than most businesses can bear," she notes.

TOOL CONTROL

When it comes to keeping tools and assets from "disappearing," there is a wide range of lockable storage, as well as complete systems for tool and asset control.

The CribMaster Inventory Management System from WinWare is one such control system. It incorporates RFID technology and tracking software to help keep tools and equipment from being misplaced, hoarded or stolen, and provides full accountability, says the company's Robert Holmes.

WinWare, a company involved in creating enterprise-wide systems that manage tools and other indirect material in the industrial workplace, has partnered with Stanley Works to offer additional value to their product line. For example, Stanley Works' Mac Tools subsidiary offers the CribMaster Accu line of modular RFID systems that ensure tools are accounted for.

Basically, the CribMaster Accu-Cab cabinets and Accu-Drawer toolboxes work in the following manner. To check out a tool or piece of equipment, a technician needs to scan his badge or enter in an employee code, making him accountable for the item, Holmes explains. The time spent using the tool, calibration schedules, inspections and more can also be monitored through the tracking capabilities of the inventory control

software.

If there are missing items or items checked out for an extended period, the software reports what is missing, for how long and who is accountable, he says. This is done through an e-mail alert and through an on-screen notification of the toolbox or cabinet. The same types of notifications take place when items are due for calibration or inspection.

Snap-on Industrial's proprietary NTC (Networkable Tool Control) keyless entry system allows employees access to the tools they need and tracks access based on employee ID key cards. All tools in the system can be serialized and linked to a specific box with the bar-code mechanism used for check out and return, says the company's Dale Alberts. After an employee scans a tool, a record is generated, so inventory is managed in real time.

The NTC system interfaces with Snap-on asset management software to ensure complete security and coverage, he notes. The software package manages not only tool check in and check out, but also repair and calibration schedules.

About the Author