TechForce lowers technician demand projection by 20%

In 2023, the TechForce Foundation's 2022 Supply & Demand Report predicted the industry would need almost one million new auto, diesel, collision, and aviation technicians by 2026. One year later, the non-profit’s projections have lowered by more than 20%. The non-profit now anticipates around 795,000 technicians will be needed between now and 2027.

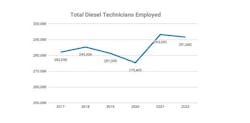

Diesel technician employment

To understand what factors are fueling the tech shortage in the diesel maintenance industry,TechForce primarily looked at technician employment and supply. For diesel, while employment numbers slipped from 293,200 technicians in 2021 to 291,600 in 2022, this still shows an improvement from the industry’s last peak in 2018 at 285,300.

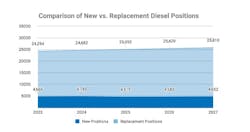

Additionally, the U.S. Bureau of Labor Statistics reported that the replacement rate for diesel techs dropped from 9.1% to 8.2% in 2022, meaning that fewer diesel technicians are expected to leave the workforce in the next few years. This aligns with TechForce's expectations that the amount of new diesel tech positions will remain relatively static from 2023-2027, while replacement positions are expected to grow by 6.2% from 2023-2027.

Read more: Love’s tech retention strategy: A career-long embrace

These numbers show an improvement from the industry in terms of retention but don’t change the fact that almost all the industry segments the foundation surveyed are expected to see more labor departures through 2032. For diesel techs, 3.6% of the labor force is expected to exit the workforce, whether from leaving the industry or retirement.

On a positive note, the report didn’t anticipate that the growth of electric vehicles (EVs) will have a large impact on technician demand for a while yet. Even though the foundation found BEVs offer an 18% reduction in labor costs, they still only account for 5.6% of the entire vehicle population, making their impact on technician demand minimal for the moment.

Taking all of these factors into account, TechForce anticipates that the industry will need 152,000 new entrant diesel techs between 2023 and 2027.

In comparison, the Bureau of Labor Statistics estimates that the bus and truck mechanics and diesel engine specialist sector will have an annual average of 24,300 openings per year into 2032, putting their estimate of needed technicians into 2027 at 97,200.

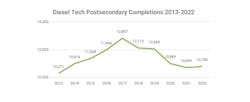

Diesel technician supply

Another critical factor in the technician shortage is the industry’s supply of talent. Unfortunately, post-secondary diesel training completions have fallen since their peak in 2017, which saw 12,807 graduates. In 2022, the industry only saw 10,780 graduates complete their training. But, to give credit where it’s due, this is a 0.75% increase from 2021’s graduation numbers of 10,699.

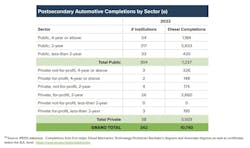

In terms of who is shepherding these prospective techs into the workforce, TechForce found that two-year public schools and private, for-profit two-year schools graduate the most diesel techs. Public, two-year institutions saw 5,633 graduates while private, for-profit, two-year schools graduated 2,660. This discrepancy could be due to how the report logged 217 public, two-year institutions in comparison to the 26 private, for-profit, two-year schools. However, private schools did have a higher average of graduates per school than public ones, at 108 and 30 completions, respectively.

According to the report, WyoTech produced the most postsecondary diesel graduates with 343, followed by the University of Northwestern Ohio, the Universal Technical Institute of Arizona Inc., and Gateway Community and Technical College.

George Arrants, vice president of the ASE Education Foundation, noted that any successful diesel program, high school or above, excels at communicating potentail career paths to their students.

"The number one reason for high school students not to take the next course offered in succession is not schedule conflicts; it's no defined career path," Arrants said. "With this generation, they're not looking for a 10- or 20-year career path. They're looking for a six-month, 12-month, 18-month, or two-year [path and asking] ‘If I work with you for a year, what do I get?’”

The schools that let their students know what the payoff will be after graduation are the ones who will see more completions, Arrants suggested.

Moving forward

Overall, while the increased number of diesel graduates is encouraging, it doesn’t mean that the industry can afford to let up on its recruiting and retention tactics. To that end, TechForce emphasized that the industry must continue to:

- Engage with students, beginning in middle school

- Build relationships with local school administrations

- Utilize internships, mentorships, and apprenticeships

- Provide funding for technical training scholarships

- Push enrollment in post-secondary training programs

With these tactics, the diesel industry can continue to make a dent in the technician shortage. As long as shops focus on improving their retention and recruitment according to what works for them and their community, hopefully the number of needed techs will continue to decrease in years to come.

"The thing I tell employers is that the technician shortage is only as bad as it is for you," Arrants concluded. "It doesn't matter what the whole world needs. It matters what you need and what can you do differently to change that."

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.