Shops failed their techs in 2024 but can fix that in 2025

WrenchWay’s mission is to connect vehicle repair techs with shops and foster good vibes about the industry overall—a noble role considering skilled trades across the board need to attract new recruits as skilled tradespeople age out. Last year they ran the Voice of the Technican survey to find out what employees thought about the industry and decided to do the same this year. This time around, the advocacy group partnered with ASE to find out where the industry stands and in what areas shops made improvements. Like the survey in 2023, they asked a wide range of questions on pay, preferred hours, what they look for in a shop, and what they want from their current shop.

WrenchWay thought the industry was on the right track until they got the data back for the 2025 Voice of the Technician Report.

According to around 2,600 vehicle repair technicians and 300 students from the auto, collision, and diesel sectors surveyed by WrenchWay this fall, shops are failing to meet their needs.

“I thought it was surprising when we first got the numbers back, because it felt like we had been trending in the right direction, and I was feeling better about where we were headed as an industry,” Jay Goninen, co-founder and president of WrenchWay, told Fleet Maintenance.

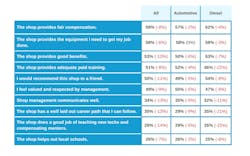

Most troubling is that on that last topic revolving around current job satisfaction, sentiment declined in 10 critical areas over the identical 2023 survey. Because this survey had the backing of ASE, this year’s sample size was five times larger, with about 4,700 total respondents versus 800 in 2023. And none garnered more than a 60% positive sentiment or a response of slightly or strongly agree to questions ranging from whether their shop provides adequate compensation to if their shop has a well laid out career path for them.

On a typical grading scale, that’s a big ol’ F.

On the diesel side specifically, there were two D-minuses. Of the 517 diesel techs surveyed, 62% of techs either strongly or slightly agreed they were fairly compensated, and 63% noted their shop provided good benefits. These were 4% and 7% lower, respectively, than 2023.

The biggest drop-off for diesel techs was for providing adequate paid training. It dropped 22% down to 46%. This was followed by shops properly laying out career paths, which dropped 21% YOY to 35%. In other words, only one in three diesel techs were happy with how the shop is managing their career advancement. And along the same lines, about the same amount said shops communicate well.

Of the ten categories, diesel dropped by double digits YOY in four categories, while auto had none.

Here’s a granular breakdown:

Respondent Profile

Technician Satisfaction with Current Employer

What we have here is…a failure to communicate

On a December WrenchWay webinar that included Goninen, WrenchWay’s other co-founder Mark Wilson dove into the data with Matt Shepanek, VP of credential testing programs for ASE, and George Arrants, the VP of ASE Education Foundation.

“I would have hoped we made some improvements, but it's red all over the board…so that's a little scary,” said Shepanek, a former tech with several years working as an OE technical trainer. “Some of it is such low-hanging fruit—things like communication. These aren't really difficult things to implement as a manager in the shop. Get your team together and talk to them.”

Though shops are clearly failing to satisfy a majority of techs in several areas, Wilson noted it’s understandable given the current environment where technology is quickly changing and there are fewer people and resources.

“No one intends to not communicate,” Wilson said. “Everyone wants to do a better job, but they get busy and they let it slip through the cracks. It doesn't mean the manager should allow that to happen, but a lot of times, I do think it's from pressures from above.”

Goninen said that pressure comes from executive leadership who judge managers solely on monthly parts and labor reports, with little thought afforded to culture.

And Arrants said the generally dismal satisfaction sentiment “screams culture—good and bad.”

And that in turn will affect hiring and retention.

“This [younger] generation wants to be part of a culture…they're looking for long-term commitment to you, the employer, but you have to make sure that your culture is designed around them wanting to stay with you.”

Changing perceptions

One major area trending downward that all vehicle repair shops must contend with is whether techs would recommend the profession to a friend. This is now at 50% after an 11% decline YOY. On the diesel side, it’s at 54%, dropping 9% from the previous survey. This is a general indication of the industry not providing an environment required to hire new techs and keep the older ones around.

“Our industry has a reputation of using people up until their bodies are done and then kind of disposing of them,” Goninen said, adding this perception needs to change. “Somehow we've got to get that person to really like the industry.”

The majority (62%) of techs surveyed have more than 21 years of experience, so it stands to reason many fleets and shops aren’t.

The industry also needs to get young people to want to grow a career here, but that’s not happening either, because shops are majorly failing in teaching new techs and compensating their mentors. Only 26% of diesel techs said their shop was doing a satisfactory job in this respect. Goninen recalled in one case a high school apprentice ghosted the shop he was training at. The shop thought everything was going great, but then finally heard from the instructor.

According to Goninen, he said something akin to, “Your tech that he was apprenticing under had told him that he should not go into this industry—that it's a terrible industry.”

And this is from a shop actually working with schools to “grow their own techs,” as Arrants and ASE advise loudly and often. Only a quarter of respondents agreed their diesel shops were doing this.

Suffice to say, Arrants didn’t mince words on the webinar.

“If you want to grow your own workforce, you can't be at 28% on those bottom two [questions on the satisfaction slide]—no two ways about it,” he asserted. “Your community probably has a program there with a pond full of entry-level people, but you’ve got to be able to communicate with them.

“And You have to choose the right mentor to onboard them into your culture and make sure they're not negatively impacted by growing your workforce,” he continued. “And if you're not involved with your local [vocational] program and local schools, you are part of the problem.”

Being part of the solution

At this point, you may be thinking your shop doesn’t have any of these problems and is passing all these metrics with flying colors. You’re a great manager, after all. And if there was a problem, it’s that techs expect too much—you’re doing the best you can.

There’s no need to get defensive, Goninen reminded. Even good shops can take the survey’s data and use it to get better.

“We can all improve on something,” he said, advising even well-run businesses to take stock of how they measure up to job satisfaction results.

It shouldn’t take long.

“Go through, write down each one of those categories and rank your own shop from one to 10, and maybe go ask your team the same exact thing and see how your answers align with your team's answers,” he suggested. “If nothing else, it just drives conversation between shops and technicians.”

Goninen did stress that any feedback you get from your technicians should be collected in a way that expresses why the feedback is being collected, and that their answers won’t have negative repercussions.

“They have to know it's safe; they have to know that they can give you good, candid feedback without getting yelled at or facing ramifications for giving you honest feedback,” Goninen said.

The great thing is that if the feedback confirms you are indeed getting high marks on things like fair pay, communication, respect, and training—while your competitors might be falling short—you can use it as a marketing tool.

“That should be a part of your messaging to try and recruit other technicians or trying to get those students in your doors,” he said.

If your feedback indicates you are failing, or you don’t even need internal feedback because you know it, don’t get discouraged.

“You're not going to change the whole industry overnight,” Wilson said. “You might not even change your whole culture overnight, but you can pick three or four things—or even start with one—and start chipping away.”

And don’t wait to make changes.

“If I was running a shop, I would look at what are the top five things that we can go ahead and try to change and implement as soon as possible,” Shepanek said.

Wilson also noted that even if you are paying well, there are other important factors the survey revealed.

Along with the areas mentioned on the satisfaction chart, here’s a breakdown of what techs and students value when looking for an employer.

What Technicians and Students Look for in Employers

And just because you may be passing now, are you setting yourself up for future success? Businesses rise and fall all the time thanks to changes in technology and changing generational values.

Shepanek said as the repair industry’s demographics get older, shops need to find ways to attract young people to the trade.

And these younger workers value transparency when it comes to career paths and job performance.

“Some of us gray hairs and no hairs, we're looking at career path for 10, 20, or 30 years,” Arrants said. “This generation is six months to two years.”

One last important tip. Let’s say you pay well, have the right shop equipment, and provide all the things techs value most. When you bring in apprentices and young techs, you absolutely need to place them with the right mentor.

“Make sure they're one of the promoters because if they don't like working for you and they don't like our industry, they're the last person you need to put in front of these young people,” Arrants said. “[New techs’] first experience doesn't need to be a negative, because if it is, there won't be a second. They'll find another industry because [the other skilled trades are] all looking for them, and we have a lot of other industries that are stealing our people.”

A webinar attendee noted that HVAC workers can make $15 more per hour than diesel techs, and Arrants noted in Texas where he lives, Buc-ees has a starting pay of $20.

“Let's do right by them, and make sure that that onboarding and that mentor is the right person, so it’s truly an investment and not an expense," Arrants concluded.

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.