Freight and economic data expected to worsen before improvements show

Things are going to look worse before they start to get better. A terrible March for truck freight is expected to be just a precursor to the worst quarter on record in the industry, according to FTR Transportation Intelligence analysis.

“We have an enormous amount of uncertainty, and that means looking ahead is difficult,” FTR Economist Bill Witte said during a recent FTR webinar on “The State of Freight.” “And even looking at exactly where we are is a little bit hard to figure out. But it's certain that the data is going to get worse before it gets better.”

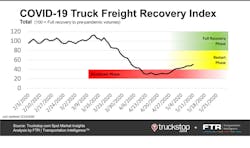

A lot of the economic data lags behind current conditions by weeks and months. Witte believes that the economy is starting to improve halfway through the second quarter of 2020, which is something that FTR and TruckStop.com’s COVID-19 Truck Freight Recovery Index (TFRI) is starting to show. Freight’s fall since the pandemic shutdown slowed the economy across the nation is easing into the restart phase, according to the TFRI. But there appears to be a long road ahead before the economy and freight see a full recovery.

While the TFRI is showing some glimmers of a restart, the market dug itself a big economic hole that won’t be easy to get out of. FTR’s Trucking Conditions Index (TCI) for March was negative 8.69 and is expected to be even lower once April’s numbers are crunched, as nearly the entire nation was under some sort of lockdown during the entire first month of 2020’s second quarter.

The TCI tracks changes in five major conditions in the U.S. truck market: freight volumes, freight rates, fleet capacity, fuel price and financing. FTR combines those metrics into a single index to show the industry’s overall health. A positive score represents good, optimistic conditions; a negative score constitutes bad, pessimistic conditions. Near-zero readings represent a neutral operating environment, while double-digit readings up or down suggest big operating changes are likely.

With March — where economic shutdowns began about midway through the month — nearing a double-digit negative number on the TCI, FTR expects a worst monthly read for April once all the data is analyzed by the end of May. After April, the freight intelligence organization is still expecting negative conditions to extend into 2021, according to FTR’s monthly Trucking Update.

“Once we see all the data for April, March will seem like the good ol’ days by comparison,” said Avery Vise, FTR’s vice president of trucking. “Trucking conditions certainly will improve beyond April, but the outlook remains uncertain both in demand and capacity as consumers, businesses, and trucking companies navigate an unprecedented contraction-and-restart dynamic that is further complicated by an ongoing health crisis and enormous financial support from Washington.”

FTR’s COVID-19 TFRI, which includes more recent data than the TCI, bottomed out in the middle of April but has been slow to show a significant rebound, noted Vise. “We’re seeing these sort of plateaus that will last for a few days, and then they’ll take a step up and they’ll plateau for more days and so on. It’s a rather uneven and certainly not a highly celebrated recovery,” he said during FTR's most recent “State of Freight” webinar.

Vise said he expects this slow recovery to accelerate and become volatile as more states reopen but added: “We’re still quite a ways away on a total truck basis from what we consider to be the beginnings of a full recovery.”

After consumers’ initial pandemic panic buying led to food shortages at grocery stores, refrigerated freight saw a wave of restocking activity in late April that lasted until early May, before recently bottoming out, Vise noted.

Looking at the COVID-19 TFRI, just the reefer segment briefly entered the “full recovery phase” at the start of May before falling back down into the “restart phase” in mid-May. Much of the early recovery was found out West, where most states are seeing a significant increase in reefer trailer volumes, according to FTR’s COVID-19 Impact Heatmap. Conversely, every state East and South of Wyoming has reefer volumes at moderately to significantly below normal ranges.

After a couple of months of Americans getting almost all their food through grocery stores, there is a slow shift back to “a more normal breakdown in how we consume food,” Vise said. “It's certainly natural that we would have another restocking phase to handle the institutional side. Again, a lot of that is still in place. Obviously frozen foods could be maintained, but of course, there was a lot of fresh food that has been discarded and has to be replaced.”

Looking at other truck markets, FTR data shows that dry van activity has rebounded off the bottom but is stuck at low levels without any significant signs of a return to normal industrial or consumer activity. While flatbed activity has not fallen as hard as dry van, its levels remain low and “has so much further to go than dry van,” according to Vise.

Economy

Before the pandemic shutdown, the economy was growing at about 2% in each of the previous three quarters before the first quarter of 2020, which saw GDP drop 4.8%. The good news, according to Witte, is this economic retraction wasn’t as bad at the 8.4% decrease in the fourth quarter of 2008, which was was the worst quarter since World War II.

“There’s also some not so good news and some bad news,” Witte added: The first two months of the first quarter were on par with the previous nine months as GDP continued to grow at about 2%. “Then we had March, when the shutdown related to the virus began to really take hold. So to get a 4.8 number when you've got two months of plus -2%, March has to be a number somewhere like minus 18% for the math to work out. That would make it the worst. If it had been three months like that it would have been the worst quarter on record.”

The first quarter of 2020 did see positive growths in the housing sector (up 21%) and in trade (up $87 billion) as imports fell more rapidly than exports, Witte noted. Despite some positive growth for the economy in the first quarter, the rest “had to be really bad” for the GDP to fall 4.8%, he said, noting that consumption and business investment fell drastically by the end of March.

If it weren’t for positive growth in the first two months of 2020, the entire quarter would have been a disaster instead of just “very bad,” Witte noted. Those bad economic numbers in March were a precursor to the bad employment numbers of late March and through April, where unemployment reached 14.7%, which Witte said is the worst monthly level on record, which goes back to the start of World War II.

A loss of 20.5 million jobs in April is “far and away the worst on record,” Witte said. “It’s enough to have wiped out nearly all of the job gains over the last 10 years since the bottom point of the Great Recession at the beginning of the last decade.”

This is going to a big part of what leads to a likely record output decline, according to Witte, who is forecasting a more than 20% decrease in GDP during this quarter. But after that, he is expecting a bounce back of about 15% in the third quarter, leading to more modest bounce backs in subsequent quarters through 2021. Those bounce backs, however, won’t be enough to return GDP to Witte’s pre-pandemic forecasts for GDP, which will still be playing catch-up well into 2022 even with the rosiest projections.

About the Author

Josh Fisher

Technology Editor

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.