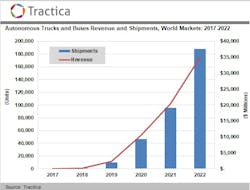

Autonomous trucks and buses to reach 188,000 vehicle sales annually by 2022

There has been an explosion of interest in self-driving vehicles in recent years, and there is no doubt that the commercial availability and adoption of autonomous vehicles will disrupt many industries. One of the industries that has already started feeling the disruption is the trucking sector, the backbone of every supply chain. The public transport industry is also not far behind as automated shared mobility and rapid transit networks begin to change the landscape of last-mile passenger transportation. By taking more cars off the road, self-driving shuttles and coaches promise cleaner air, reduced noise pollution, and safer areas to walk and ride.

According to a new report from Tractica, a market intelligence firm, worldwide revenue from sales of autonomous trucks and buses reached $84 million in 2017 and the market will continue to develop at a strong pace over the next few years with more competition within the industry, providing significant opportunities to various industry participants, and reaching global revenue of $35 billion by the end of 2022. During that period, the market intelligence firm forecasts that annual unit sales will increase from approximately 343 vehicles in 2017 to 188,000 units in 2022.

“The potential for autonomous trucks and buses is huge and market growth is accelerating, with news of successful pilot projects coming at an increasing pace,” says research analyst Manoj Sahi. “Considering the next 2 to 3 years as a make or break time, several prominent companies are prioritizing investment for large-scale development.”

Tractica’s report, “Autonomous Trucks and Buses”, examines the market and technology issues surrounding autonomous trucks and buses and provides 6-year market sizing and forecasts for their shipments and revenue during the period from 2017 through 2022. The report focuses on crucial market drivers and challenges and assesses the most important technology issues that could influence market development. In total, 32 industry players are profiled. Market forecasts are segmented by world region and vehicle type.