Fuel economy, maintenance driving shorter lifecycles, Fleet Advantage finds

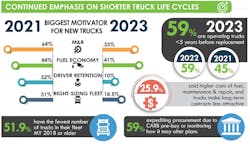

For the second year in a row, Fleet Advantage's benchmarking survey found the majority of fleets prefer truck life cycles of fewer than five years. Of the fleets surveyed, 59% chose this shorter ownership period in 2022 and 2023, up from 45% in 2021. The primary reasons were the better fuel economy (40.7%) and lower maintenance (33.3%) that newer trucks offer.

In particular, fuel is more of a concern due to diesel price volatility caused by conflicts in Ukraine and the Middle East, as well as government regulations. The impending emissions regulations dictated by California Air Resource Board are also playing a role in fleet buying behavior, Fleet Advantage data suggests. Nearly 60% of respondents are "expediting procurement due to CARB pre-buy or are closley monitoring how it may alter plans," the company said.

“It continues to be clear that business agility, financial flexibility, and a strategic eye toward future fuel options remain front and center for companies with transportation fleets and for-hire fleets,” said Brian Antonellis, CTP, Senior Vice President of Fleet Operations, for Fleet Advantage.

Fleet right-sizing to meet current (gloomy) economic conditions was a motivator for 18.5% of respondents. Notably, the current freight recession has claimed megacarrier Yellow Corp. and Convoy on brokerage side since August.

In their annual Analysis of the Operationa Costs of Trucking Updates, the American Transportation Research Institute (ATRI) also found a trade cycle decrease. Their respondents went from from 8.7 years in 2021 to 8.2 years in 2022. Two years ago, the supply chain was still reeling from supply chain disuptions due to the pandemic.

But now trade cycles are climbing down again, closer to the four-year trade cycle that was common before the pandemic, explained Dan Nynas, COO, Diesel Laptops. Leah Shaver, president and CEO of the National Transportation Institute, told Fleet Maintenance’s sister publication, FleetOwner, that there are more assets on the ground than there are freight, and ACT Research’s report State of the Industry: U.S. Trailers stated that trailer backlogs are 21% lower y/y from 2022.

Of course, tightening emissions regulations have their part to play in this shift, too. ACT Research anticipates that CARB pre-buy due to looming looming emissions requirements expedited new vehicle procurement with more advanced technology. This prediction is corroborated by Fleet Advantage’s report that 59% of respondents are speeding up their vehicle purchases due to regulations, or at least considering how these regulations will impact their fleet’s vehicle changeover.

Additionally, the benchmark report found that fleet perspectives on alternative fuel truck adoption have changed as well. Last year, 65% of the survey participants were most interested in electric trucks, versus 15% for hydrogen, or fuel cell electric trucks. In 2023, only one-third of survey respondents picked EVs, while 38.5% were most interested in hydrogen. This could be due to more knowledge of the limitations of EVs as they develop, whether in terms of vehicle range or the complexity and scarcity of charging infrastructure.

This was reflected in what respondents identified as barriers to adoption for alt-fuel vehicles.

The concerns over cost and calculating ROI were a concern to 90% of respondents. To that end, more than half would prefer leasing electric or fuel cell trucks over owning them. A quarter of those surveyed said they "do not see value in adopting EV nor hydrogen trucks," and will need to see far more real-world benefits before changing their minds.

Fleet Advantage noted they have rolled out a software tool called EVAN (Electric Vehicle Analytic Navigator) that compares diesel versus an electric class 8 vehicle TCO. The modeling evaluates fuel and mileage data versus kWh comparisons from the first year through a six-year life cycle.

Despite having "EV" in its name, EVAN doesn't favor the zero-emission vehicles, finding that in certian examples leasign diesel will save fleets tens of thousands due to the initial finance expense. Electric trucks maintenance and repair and fuel costs were lower, though.

“The maintenance and repair costs are probably going to be about 25% less than a diesel from what we’ve seen so far—and could be as much as 30%,” Hadley Benton, EVP of business development at Fleet Advantage told Fleet Maintenance earlier this year. “The fuel cost advantage is probably about 40-45%.”

As far as the inital costs are concerned, CARB and other agencies in California offer generous grants, and more funding can be had through federal programs seekign to cut emissions, though fleets can't count on taxpayers to subsidize their equipment purchases in perpituity.

“Everybody has different needs; they have different reasons for doing it,” Hadley offered. “But ultimately, [electrification] needs to make economic sense at the same time, balancing that with reducing your greenhouse gas emissions and greening your fleet.”

About the Author

Alex Keenan

Alex Keenan is an Associate Editor for Fleet Maintenance magazine. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.