Ryder study finds EV business case “just isn’t there yet” for many fleets

According to a comprehensive study on EV operating costs by Ryder Systems, the logistics provider found mixed fleets using EVs could spend two-thirds more on their total costs to transport versus their ICE counterparts. Light-duty transit vans fared the best, with only a 5% increase in costs, while a fleet could spend 114% more to move freight with an electric heavy-duty truck versus a diesel one.

The analysis used a 1:1 comparison between ICE and EV vehicles in its calculations, but it turned out to be 2:1 in the heavy-duty section due to how the ICE tractor was assumed to haul 29,000 lbs., while a Class 8 EV’s max payload is around 22,000 lbs. Because of this disparity and charging times, a fleet would need nearly two heavy-duty EV tractors (1.87) and two drivers to equal a similar diesel truck’s productivity, leading to a 500% increase in equipment costs.

The data for the study came from the representative loads of more than 13,000 drivers within Ryder’s dedicated fleet operations. The company also factored in the vehicle cost, price of diesel fuel versus electricity, maintenance time and costs, driver availability, range, payload, and charging and delivery times for their total cost to transport. For charging, the study assumed the fastest chargers available were used, despite noting these are not universally available.

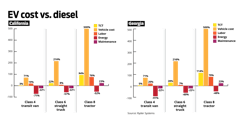

One-to-one diesel versus EV comparisons were conducted across several classes. The study authors ran the comparisons for both California, where electricity, fuel, and labor costs are typically highest; and Georgia, where they are lower.

Here’s how EVs fared in California:

Class 4 transit van:

- TCT: +3% ($5,000 annual increase)

- Vehicle cost: +71%

- Labor: + 19%

- Energy: -71%

- Maintenance: -22%

Class 6 straight truck:

- TCT: +22% ($48,000 annual increase)

- Vehicle cost: +216%

- Labor: +8%

- Energy: -57%

- Maintenance: -22%

Class 8 tractor:

- TCT: +94% ($315,000 annual increase)

- Vehicle cost: +500%

- Labor: +76%

- Energy: -52%

- Maintenance: +23%

Georgia:

Class 4 transit van:

- TCT: +5% ($8,000 annual increase)

- Vehicle cost: +71%

- Labor increase: +20%

- Energy: -91%

- Maintenance: -22%

Class 6 straight truck:

- TCT: +28% ($53,000 annual increase)

- Vehicle cost: +216%

- Labor: +7%

- Energy: -60%

- Maintenance: -22%

Class 8 tractor:

- TCT: +114% ($330,000 annual increase)

- Vehicle cost: +500%

- Labor increase: +79

- Energy: -48%

- Maintenance: +23%

The whitepaper also included a mixed fleet comparison of 25 vehicles: 11 vans, 4 straight trucks, and 10 tractors. Electrifying would lead to an additional $3.4 million cost impact, or a 56% increase.

Read more: Can ZEV production, infrastructure scale in time for GHG3?

Light-duty EVs a bright spot

“For some customers with specific EV applications—such as light-duty EV transit vans making last-mile deliveries in urban areas, for example—our analysis shows that the TCT can make sense,” Karen Jones, EVP and head of new product development at Ryder, told Fleet Maintenance. She added select state and federal grants and incentives can also even out costs for other operations, as well.

Even with the generous amount of tax money the current administration has commandeered to subsidize zero-emission technology, trucking companies are not clamoring for these electric trucks due to the two things fleets absolutely need to remain profitable: affordability and reliability.

“For many of our customers, the business case for converting to EV technology just isn’t there yet, given the limitations of the technology and lack of sufficient charging infrastructure,” stated Ryder CEO Robert Sanchez, who noted the company has not seen “significant adoption of this technology.”

Ryder itself made a significant investment in adopting EVs and has tested the gamut of freight-moving commercial EVs, from the Ford E-Transit to the Freightliner Cascadia semi. By next year, the company expects to deploy 4,000 BrightDrop Zevo delivery vans and has reserved some Tesla Semis as well. Last year, a “turnkey” advisory product called Ryder Electric+ was launched to help fleets figure out where EVs make sense in their operations and which of the dozens of options would provide the best value and performance. After deployment, the Ryder consultants can also help manage charging, telematics, and maintenance.

Behind the study

Based on those TCT hikes a fleet simply cannot ignore, this study appears to undercut Ryder’s EV business, or at least make potential fleet customers hesitate on pulling the trigger on EVs. So why did Ryder conduct the study?

”With regulations continuing to evolve, we wanted to better understand the potential impacts to businesses and consumers if companies were required to transition to EVs in today’s market,” Sanchez explained.

The latest regulations include the U.S. Environmental Protection Agency’s Greenhouse Gas Emissions Phase 3 standards. In one proposed scenario, for heavy-duty truck manufacturers to satisfy the final rule, 40% of their day cabs and 25% of their sleepers would need to be classified as zero-emission vehicles.

ZEVs are not the only path to compliance, Jones noted: “In the new EPA GHG phase 3 specifications, there are multiple ways for OEMs to produce vehicles that will reduce emissions, including electric, natural gas, hydrogen, hybrids, and carbon capture, as well as continuing to advance diesel emissions technology.”

But Jones also acknowledged Ryder’s “analysis assumes the accessibility and use of the fastest applicable commercial vehicle chargers, even though this network infrastructure is not yet built out,” which “is a generous assumption.”

Based on heavy-duty trucks costing up to $330,000 extra per year in TCT, it would appear the suggested ZEV-heavy pathway will not be ready in a short seven years, and more renewable diesel, CNG and other alt-fuels will fill in.

Jones also clarified that the data used was based on current market prices. Even though prices may come down by the time commercial EVs reach wider adoption, that is far from a certainty.

“We did not factor in a gradual lowering of costs, because these are uncertain,” she said. “It would take a breakthrough technology to improve the range and payload for heavy-duty EV tractors to make them equivalent to diesel tractors, while also keeping vehicle costs comparable. Additionally, the OEMs haven’t provided clear guidance on when vehicle pricing may come down. And, without cost parity, we can’t expect many businesses to adopt EVs, certainly not at the scale needed to achieve manufacturing efficiencies.”

Ryder did make one prediction on the future: that carriers won’t just absorb the additional costs, and the rise in TCT wrought by EVs will pass down to consumers. This was projected to add 0.5-1% to overall inflation, with the Consumer Price Index data indicating that inflation is already up nearly 20% since 2021.

To see the full report, download the paper at: ryder.com/en-us/evtct.

About the Author

John Hitch

Editor-in-chief, Fleet Maintenance

John Hitch is the award-winning editor-in-chief of Fleet Maintenance, where his mission is to provide maintenance leaders and technicians with the the latest information on tools, strategies, and best practices to keep their fleets' commercial vehicles moving.

He is based out of Cleveland, Ohio, and has worked in the B2B journalism space for more than a decade. Hitch was previously senior editor for FleetOwner and before that was technology editor for IndustryWeek and and managing editor of New Equipment Digest.

Hitch graduated from Kent State University and was editor of the student magazine The Burr in 2009.

The former sonar technician served honorably aboard the fast-attack submarine USS Oklahoma City (SSN-723), where he participated in counter-drug ops, an under-ice expedition, and other missions he's not allowed to talk about for several more decades.